Morsa Pictures | Stone | Getty Pictures

Retirement accounts are supposed to fund your life-style in later years — and raiding them early usually comes with a stiff monetary penalty.

However there are some conditions during which account house owners — each these with financial savings in particular person retirement accounts and office plans like a 401(ok) — can entry that cash early with out penalty.

Not that they need to essentially accomplish that.

“The worst factor you are able to do is take out of your retirement account earlier than its meant goal, as a result of then what will probably be on your retirement?” mentioned Ed Slott, an authorized public accountant and IRA knowledgeable primarily based in Rockville Centre, New York. “I’d solely do that if it was the final resort and this was the one cash you had.”

Extra from Private Finance:

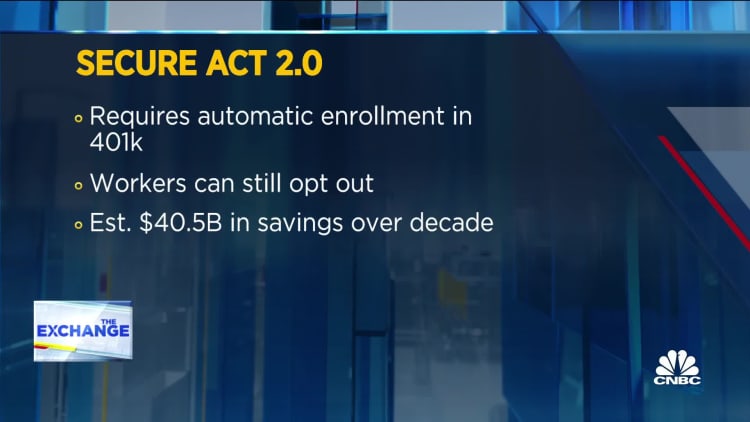

Secure 2.0 bill on track to usher in retirement system improvements

New retirement legislation leaves a ‘huge problem untouched’

New emergency savings rules may help boost financial security

Savers usually incur a 10% tax penalty in the event that they withdraw cash from a retirement account earlier than age 59½. That is on prime of any earnings taxes ensuing from the withdrawal.

The record beneath outlines conditions during which IRA house owners would not owe the ten% early withdrawal penalty.

Congress could quickly add extra. A $1.7 trillion legislative package deal to fund the federal authorities for the 2023 fiscal 12 months contains a slew of retirement provisions, collectively named “Secure 2.0.” The measure, anticipated to cross inside days, would add exceptions to the early-withdrawal penalty for IRA house owners in circumstances of home abuse and terminal sickness, for instance.

Listed here are the current exceptions for these beneath 59½.

(Observe: The primary three apply solely to IRAs. The others could apply to each IRAs and office retirement plans.)

1. Larger schooling bills

You could be exempt from the penalty if IRA funds are used to pay qualifying higher-education prices for you, your partner, or youngsters or grandchildren of you or your partner.

Eligible prices embrace tuition, charges, books, provides, tools required for a pupil’s enrollment or attendance and bills for sure special-needs companies. Room and board additionally qualify for college students who attend faculty at the very least half-time.

College students should attend a school, college, vocational faculty or different establishment that may take part in U.S. Division of Schooling pupil help applications. (They embrace “just about all” accredited, public, nonprofit, and privately owned for-profit establishments, in keeping with the IRS.)

2. ‘First time’ house purchaser

Opposite to what the IRS title may recommend, IRA house owners do not essentially should be first-time house consumers to avail themselves of this exception. The IRS usually defines a first-time purchaser as somebody who hasn’t owned a house within the final two years.

Such IRA house owners can withdraw as much as $10,000 penalty-free. This greenback threshold is a lifetime most.

The funds should be used for “certified acquisition prices.” These are: the prices of shopping for, constructing or rebuilding a house, and “any standard or cheap settlement, financing, or different closing prices,” in keeping with the IRS. The cash should be used inside 120 days of receipt.

The IRA withdrawal can be utilized for you, a partner or your little one, amongst different qualifying members of the family. If each you and your partner are first-time homebuyers, every can take distributions as much as $10,000 with out penalty.

The 2-year-limitation interval begins on the “date of acquisition”: the day on which you enter right into a binding contract to purchase, or on which the constructing or rebuilding begins.

3. Medical health insurance if unemployed

Distributions to cowl medical insurance premiums for you, a partner and dependents is probably not topic to a penalty when you misplaced your job.

To qualify, you have to have obtained unemployment compensation (through a federal or state program) for 12 consecutive weeks. The IRA withdrawal should additionally happen the 12 months you obtained unemployment, or within the following 12 months. Additional, you have to take the withdrawal inside 60 days of being reemployed.

4. Demise

RubberBall Productions | Getty Pictures

Beneficiaries who inherit an IRA upon the proprietor’s loss of life usually aren’t topic to a penalty in the event that they pull cash from the inherited account earlier than age 59½.

5. Unreimbursed medical bills

A distribution to cowl medical prices may not be subject to penalty.

The exception applies to unreimbursed medical bills that exceed 7.5% of your annual adjusted gross earnings. The relevant earnings is that throughout the 12 months of withdrawal.

For instance, in case your AGI is $100,000 in 2022, you should utilize a withdrawal this 12 months to cowl unreimbursed medical bills over $7,500.

You needn’t itemize tax deductions to get this profit. (In different phrases, you possibly can nonetheless get it when you take the usual deduction.)

Slott cautioned towards one end-of-year snag. In case you put a medical invoice in your bank card this week or subsequent, that medical expense would depend for the 2022 tax 12 months — even when the credit-card invoice itself is not paid till 2023.

Which means an IRA withdrawal linked to that medical expense must happen in 2022, not 2023, to get the tax profit.

6. Start or adoption

Every dad or mum can use as much as $5,000 per start or adoption from their respective retirement accounts. The funds would cowl related bills.

The account withdrawal should be made throughout the 12 months after your little one was born or the date on which the authorized adoption of your little one was finalized.

7. Incapacity

Sure disabled retirement savers beneath age 59½ aren’t beholden to the tax penalty.

To qualify, they should be “completely and completely disabled.” The IRS defines this as being unable to do “any substantial gainful exercise” due to bodily or psychological situation. A doctor should certify the situation “will be anticipated to lead to loss of life or to be of lengthy, continued, and indefinite period.”

In all, it is a inflexible definition that is laborious to satisfy, Slott mentioned. In follow, somebody should usually be close to loss of life or bedridden and unable to work, he mentioned.

8. IRS levy

You will not incur a penalty if the distribution outcomes from an IRS tax levy (i.e., if the IRS takes your retirement funds to fulfill a tax debt).

9. Energetic reservists

Videodet | Istock | Getty Pictures

Reservists within the Military, Navy, Marine Corps, Air Drive, Coast Guard or Public Well being Service could also be exempt from penalty.

They will need to have been ordered or referred to as to lively responsibility after Sept. 11, 2001, and in responsibility for 180 or extra days or for an indefinite interval.

Their account distribution cannot be made sooner than the date of the decision to lively responsibility and no later than the shut of the active-duty interval.

10. Considerably equal periodic funds

This exemption for IRA house owners is “very difficult” and certain requires the assistance of an accountant or advisor, Slott mentioned.

In fundamental phrases, a taxpayer can keep away from a penalty by sticking to a components that outlines an quantity of periodic account distributions (at the very least one per 12 months). These “considerably equal periodic funds” are like an annuity, and are also called 72(t) funds.

Not solely should the saver decide the correct amount to withdraw, however they need to additionally follow the schedule till age 59½ — leaving ample room for error, relying on the time scale, Slott mentioned.

Getting it improper will be pricey. Taking the improper quantity one 12 months, for instance, would void the exception, and the taxpayer would owe the ten% penalty for annually of withdrawals that already occurred.

“It is a very harsh penalty,” Slott mentioned.