Damon_moss | Istock | Getty Photos

This has been a 12 months of alternative for traders who took to coronary heart the outdated Wall Road adage that “the time to purchase is when there’s blood within the streets.”

Certainly, a market drop can show to finest the very best time to make the most of varied monetary planning alternatives. A few of the hottest methods this 12 months amongst traders trying to profit from a challenging environment have included tax-loss harvesting, Roth individual retirement account conversions and shopping for the dip as shares proceed to plunge.

For top-net-worth traders, there could also be extra planning concerns that shouldn’t be neglected. Listed here are three methods to debate together with your trusted advisor earlier than the 12 months ends.

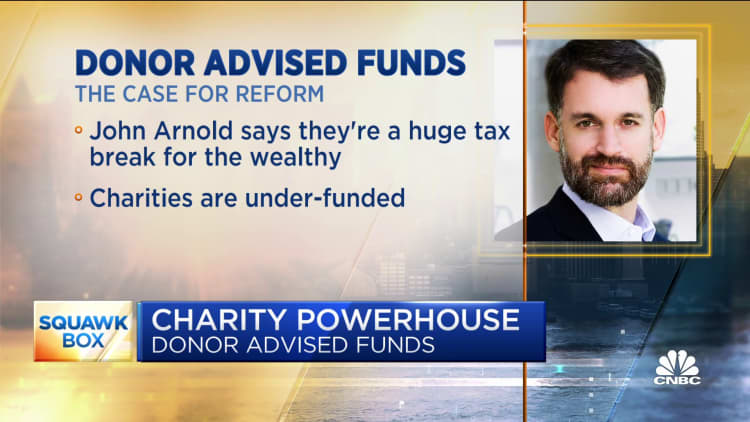

1. Use a donor-advised fund to ‘bunch’ donations

A donor-advised fund is an funding account whose function is supporting charitable organizations. A donor is eligible for a direct tax deduction when contributing money, securities, or different belongings to a DAF. These funds can then be invested for tax-free development till the donor decides to distribute them.

Grants might be made to any certified public charity, straight away or over time. A DAF is especially helpful when an investor owns a safety with no value foundation, a extremely appreciated inventory or a long-time held concentrated place. In all these situations, a capital good points tax legal responsibility might be averted by shifting the place to a DAF.

A DAF can also be beneficial when “bunching” charitable contributions. On this strategy, one would contribute a number of years’ value of charitable contributions to their DAF unexpectedly.

This technique addresses the truth that charitable contributions are solely tax-deductible for individuals who itemize their deductions. The standard deduction for 2022 is $12,950 for single filers and $25,900 for joint filers.

“Bunching” charitable contributions by using a DAF permits a donor to exceed the usual deduction and take the itemized deduction this 12 months, whereas providing the flexibleness to nonetheless distribute the funds over the present and subsequent years.

2. ‘Freeze’ decrease worth of belongings for gifting functions

For ultra-high-net-worth households, making items at this time on the depressed market costs is a chance to extra tax effectively shift funds out of a family’s estate. For the reason that gifted belongings are “frozen” at at this time’s decrease values, they burn up much less of the federal lifetime gift tax exemption.

The exemption is $12.06 million per individual for 2022, however is ready to revert to $5.49 million after 2025. At present ranges, a married couple with an property above $24.12 million, or $10.98 million after 2025, could also be hit with federal property tax. Gifting funds to relations or into properly structured trusts might assist decrease the tax somebody’s property might want to pay at their demise.

3. ‘Superfund’ a 529 for property, legacy planning objectives

A 529 is a tax-advantaged college savings account that will present rapid tax financial savings, tax-free development and tax-free distributions if the funds are used for certified instructional bills. Most states require you to put money into their in-state plan to obtain the deduction for contributions. Nonetheless, there are a number of states which might be thought of tax parity the place you should use any state’s 529 plan to obtain the deduction.

The annual present exclusion in 2022 is $16,000. Which means an investor can present every individual $16,000 this 12 months present tax-free. The annual present exclusion recycles on Jan. 1, so if somebody does not use their 2022 present allowance by Dec. 31, they lose it.

Excessive-net-worth households that need to assist fund a member of the family’s greater training ought to take into account “superfunding” 529 accounts. On this strategy, you possibly can frontload 5 years’ value of tax-free items right into a 529 account. A married couple not making every other items to the beneficiary throughout the five-year interval can contribute as much as $160,000 to a 529 plan for every baby and, with the right election, not run into present tax issues.

This can be a sensible manner for somebody to make the most of tax effectivity to get cash out of their property whereas serving to to fund a liked one’s greater training.

— Jonathan Shenkman, president of Shenkman Wealth Administration