Fotostorm | E+ | Getty Pictures

For a rising share of automobile house owners, month-to-month auto mortgage funds seem like evolving into an issue.

Whereas debtors who’re behind on their funds by greater than 60 days characterize a tiny portion of all excellent auto loans — 1.84% — their ranks are rising, based on a recent report from Cox Automotive. The share was 26.7% larger in December than the year-earlier month and is essentially concentrated amongst debtors with low credit scores.

“The hazard of struggling to pay an auto mortgage is not only risking your automobile getting repossessed, it is the long-term influence on the entire different areas of your funds,” mentioned licensed monetary planner Angela Dorsey, founding father of Dorsey Wealth Administration in Torrance, California.

Excessive costs, rates of interest have led to greater funds

A mix of market components have pushed up month-to-month mortgage funds. And as personal savings have dwindled and protracted inflation has squeezed household budgets, maintaining with funds might turn out to be much more difficult.

The common worth paid for a brand new automobile reached a report $47,362 in December, based on an estimate from J.D. Energy and LMC Automotive.

Month-to-month funds within the fourth quarter averaged $717, in contrast with $659 a yr earlier, based on Edmunds. The share of consumers who took on month-to-month payments of $1,000 or more reached 15.7%, in contrast with 10.5% a yr earlier. Within the fourth quarter of 2020, simply 6% of debtors had month-to-month auto funds that giant.

Extra from Private Finance:

How to protect yourself from tax fraud and scams

What the Fed’s interest rate hike means for you

States are holding $70 billion in unclaimed assets

Rising interest rates even have affected affordability. The common charge paid on a brand new automobile mortgage was 6.5% on the finish of 2022, Edmunds information exhibits. For used vehicles, the typical was 10%. A yr earlier, these charges have been 4.1% and seven.4%, respectively.

Mortgage delinquencies can hurt your credit score rating

Whereas the auto mortgage delinquency charge is edging larger, the default charge will not be, based on Cox. Getting into default — when your lender determines you aren’t going to pay, normally a while after 90 days of no funds — can translate into your automobile being repossessed.

But even being too late on one cost has a destructive impact in your monetary life, and it may be long-lasting.

“In the event you’re 30 days late, it impacts your credit score rating,” mentioned Brian Moody, govt editor of Kelley Blue Guide.

That is when lenders sometimes report the late cost to credit-reporting corporations Equifax, Experian and TransUnion.

Additionally, you ought to be conscious that as a result of your cost historical past is essentially the most influential consider your credit score — it sometimes accounts for 35% of it — you can see a drop of 100 points resulting from being 30 days late with a cost, based on NerdWallet. The longer the mortgage goes unpaid, the larger the hit to your rating, and that delinquency can stay in your credit score report for as much as seven years.

As customers typically know, the decrease your rating, the extra possible you’re to pay larger rates of interest on new loans or credit score you get. Moreover, a poor rating or poor credit score historical past might trigger you to pay larger premiums on auto or home-owner’s insurance coverage and have an effect on your capability to rent an condominium and even get a job. Employers cannot see your rating, however they’ll check your report.

What to do for those who’re battling auto mortgage payments

For automobile house owners who’re fairly positive they’re heading towards delinquency, it is essential to strive stopping the issue from snowballing.

“In the event you sense that is coming, be on high of it,” Moody mentioned. “Do not do nothing. It will not get higher by itself.”

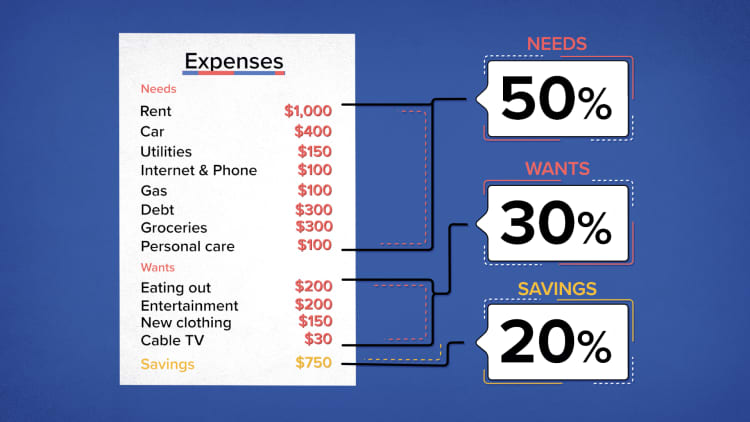

In the event you’re struggling to maintain up since you do not finances properly, that is no less than probably fixable, specialists say. In that case, take a tough have a look at the way you’re spending cash.

“Check out your total bills for the previous couple of months,” mentioned Joe Pendergast, vice chairman of shopper lending for Navy Federal Credit score Union. “You’ll be amazed how a lot the typical particular person spends every month with out realizing it.”

Nevertheless, if the funds are merely not manageable, the very first thing you must do is convey your lender into the loop.

“If a shopper is struggling to make their automobile funds, or anticipates challenges forward, they need to attain out to their monetary establishment as quickly as doable,” Pendergast mentioned.

The earlier your financial institution or credit score union is made conscious, the simpler it’s to provide you with doable options.

Joe Pendergast

Vp of shopper lending for Navy Federal Credit score Union

“The earlier your financial institution or credit score union is made conscious, the simpler it’s to provide you with doable options,” he mentioned.

Whereas the choices differ from lender to lender, you could possibly get a deferment — i.e., a number of months with no cost — or a brand new mortgage that lowers the funds by stretching out the size. Both means, bear in mind that this typically would result in paying extra in curiosity, famous Moody of Kelley Blue Guide.

Nevertheless, a deferment would no less than offer you time to determine how you can greatest handle your scenario, he mentioned.

For instance, you can promote your automobile with the intent of shopping for a lower-priced one — or, maybe, even going with out one when you’ve got different transportation choices. Simply bear in mind that relying on how a lot you owe on the mortgage, the value you get to your automobile might not totally cowl your stability, which might imply you’d nonetheless owe the lender cash.

There could also be the same worth hole for those who decide to commerce it in. Whereas trade-in quantities have been comparatively excessive resulting from used-car values being elevated, that’s altering. The newest inflation studying confirmed a year-over-year drop of 8.8% in used automobile costs.

And if the quantity a supplier is keen to present you is lower than what you owe on the mortgage, you’ll both must repay the remaining stability or roll it into your new mortgage. This so-called destructive fairness averaged $5,341 within the final quarter of 2022, Edmunds information exhibits.

“None of those [options] are ultimate,” Moody mentioned. “They’re all beneath the heading ‘higher than nothing.'”