Arising with the money to cowl an sudden emergency expense generally is a problem for a lot of people and households.

Research present an unexpected expense of even $400 might immediate folks to borrow to cowl the associated fee. When confronted with such payments, staff could also be tempted to faucet their retirement financial savings accounts.

Now, new provisions in retirement legislation called Secure 2.0 transferring ahead on Capitol Hill would make it simpler for staff to put aside emergency funds.

The primary change would make it so retirement plan sponsors might routinely enroll workers to put aside as much as $2,500 of post-tax cash in a separate emergency financial savings alongside their retirement accounts. Staff might defer cash to the emergency financial savings accounts routinely by their payroll deduction.

Extra from Private Finance:

‘Secure 2.0’ on track to usher in retirement system upgrades

As retirees face poverty, these 4 policy changes may help

Not having an emergency fund can lead to this money mistake

The second change would enable retirement plan members to withdraw as much as $1,000 from their retirement financial savings per calendar 12 months to cowl emergency bills with out incurring a penalty. Nonetheless, the borrower must change these funds throughout the following three years earlier than making one other related withdrawal.

Notably, a plan for separate standalone emergency financial savings accounts exterior of retirement plans didn’t make it into the laws. That would have helped the practically 50 million staff who do not need entry to retirement plans by their employer, mentioned Shai Akabas, director of financial coverage on the Bipartisan Coverage Middle.

“I’m cautiously optimistic that within the subsequent 12 months or two that that would move on another laws that might enable for employers to set this up separate and aside from the retirement plan as nicely,” Akabas mentioned.

Progress after six years of bipartisan efforts

Nonetheless, the emergency financial savings modifications, notably the $2,500 sidecar accounts, might make an enormous distinction, he mentioned, following efforts that started in 2016 with a Bipartisan Coverage Middle retirement fee and a subsequent proposal from Sens. Cory Booker, D-N.J., and Todd Younger, R-Ind.

“There must be extra consideration paid to the emergency financial savings challenges on this nation and extra instruments given to rank-and-file People,” Younger mentioned on a current Bipartisan Coverage Middle panel.

Whereas some firms have already begun to check out emergency financial savings plans for workers, a key distinction is that this laws will give them the flexibility to routinely enroll members, Akabas famous.

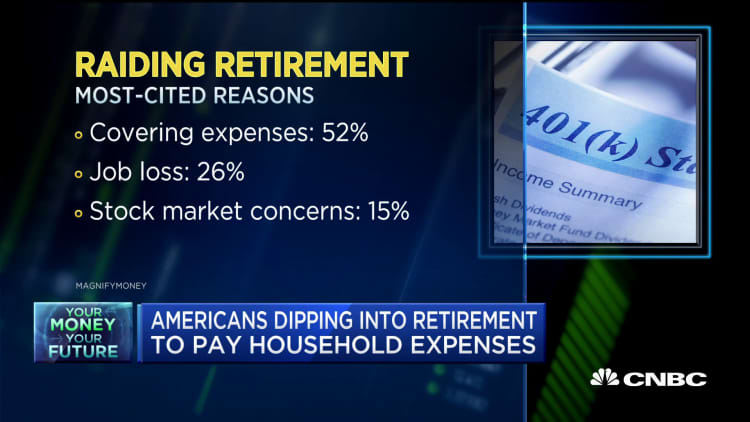

With out devoted emergency funds, people typically flip to their retirement accounts once they face a money shortfall, which might result in the unravelling of their monetary safety.

Within the aftermath of the Covid-19 pandemic, Congress made these retirement property extra accessible, which was a wake-up name as to how a lot folks are inclined to lean on their retirement plans when they’re financially pinched, in line with Jeff Cimini, head of retirement product at Voya Monetary.

“They only took much more than we ever anticipated,” Cimini mentioned.

As excessive inflation has raised the price of dwelling, retirement savers are nonetheless turning to their retirement accounts to assist cowl money shortfalls. Recent data from Vanguard Group confirmed the share of retirement savers who withdrew from their 401(okay)s to cowl monetary hardships hit a file excessive in October.

With out fixing the short-term financial savings shortfall, it is going to be unimaginable to resolve long-term retirement financial savings wants, Cimini mentioned.

“Voya is massively supportive of the institution of an emergency financial savings possibility throughout the context of a retirement plan,” Cimini mentioned.

Bigger employers more likely to lead means on adoption

Thomas Barwick | Digitalvision | Getty Photographs

The mix of a retirement account with an emergency fund might help talk to workers that they should put aside funds for each their short- and long-term wants. As soon as they do, their retirement funds is not going to be the primary place they withdraw from.

“We’re very optimistic that this can actually have a big effect on long-term retirement safety for the U.S. labor pressure,” Cimini mentioned.

Bigger plan sponsors will in all probability cleared the path with adoption of those provisions, Cimini predicted.

Firms have already begun experimenting with emergency financial savings advantages. Funding agency BlackRock has created a philanthropic Emergency Financial savings Initiative that has examined choices with firms like payroll providers firm ADP and client electronics retailer Finest Purchase.

Most individuals will not get monetary savings except their employer by some means does it for them by a payroll deduction.

Suze Orman

private finance knowledgeable

Private finance knowledgeable Suze Orman has co-founded fintech firm SecureSave that allows employers to arrange emergency funds for workers that embrace computerized contributions and matches.

“Employers must get entangled on this, as a result of most individuals will not get monetary savings except their employer by some means does it for them by a payroll deduction,” Orman mentioned at a current Bipartisan Coverage Middle panel.

The proposed Safe 2.0 modifications are an enormous acknowledgement from Congress that change is required, mentioned Timothy Flacke, co-founder and govt director of Commonwealth, a nonprofit targeted on constructing monetary safety for susceptible populations that’s working with BlackRock’s initiative.

“Congress has primarily mentioned that short-term monetary safety issues,” Flacke mentioned. “And that in and of itself is a very huge deal.”

The modifications might not imply everybody will abruptly have ample emergency financial savings, he mentioned. However they’ll make having cash put aside far more attainable for folks, which is a good begin.

“There are actual folks on the market who will confront very actual, very high-cost, very painful monetary emergencies who’re more likely now to have a couple of hundred bucks of their very own cash that they’ll draw,” Flacke mentioned.