courtneyk | E+ | Getty Photos

After a tough 12 months for the inventory market, buyers might not anticipate to obtain a shock tax invoice from year-end actively managed mutual fund payouts, specialists say.

When a fund supervisor sells underlying property at a revenue with out losses to offset it, these features are handed alongside to buyers. The income are taxable to buyers when obtained in a brokerage account.

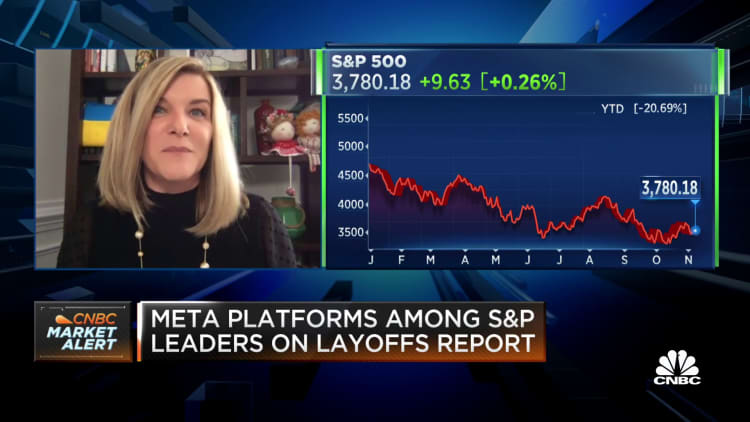

Whereas the S&P 500 is down greater than 20% for 2022, many funds began the 12 months with beforehand embedded features, in keeping with Morningstar. And a few fund managers offered worthwhile underlying property as cash has continued shifting from energetic to passively managed funds.

Consequently, some buyers might even see year-end mutual fund distributions, regardless of inventory market losses in 2022, the report discovered.

Extra from Private Finance:

How to use pay transparency to negotiate a better salary

6 health insurance terms you need to know as open enrollment begins

What the Fed’s fourth 0.75 percentage point rate hikes means for you

“It is a double whammy,” mentioned Tommy Lucas, an authorized monetary planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida.

Whilst you’ll owe long-term capital gains taxes of 0%, 15% or 20% for property held for multiple 12 months, you may additionally owe common earnings taxes for investments owned for lower than one 12 months.

Lucas mentioned mutual fund payouts typically “slip below the radar” and have to be included as a part of an investor’s year-end tax planning.

When to anticipate year-end mutual fund payouts

Usually, mutual fund payouts occur as soon as per 12 months, by mid-December, after funds announce estimates in late October or early November, defined Stephen Welch, a supervisor analysis analyst at Morningstar.

After receiving a mutual fund’s estimate, you’ve till the “date of report,” or the final day to be listed for a payout, to make possession modifications.

Morningstar’s report covers present distribution estimates for a few of the bigger funds, with extra updates coming in mid-November.

Contemplate tax-loss harvesting to cut back capital features

Many buyers did not anticipate year-end mutual fund distributions in 2021, mentioned Jim Guarino, a CFP, CPA and managing director at Baker Newman Noyes in Woburn, Massachusetts.

“I do know that plenty of my shoppers have been simply completely blown away,” he mentioned.

However this 12 months’s market decline might provide a silver lining — the chance to offset income with losses, often called “tax-loss harvesting” — assuming your complete tax situation and take motion by year-end, mentioned Guarino.

“You have to construct in that variable,” he mentioned, noting that it is too late to cut back your capital features taxes for 2022 when you begin receiving tax types from brokers in January or February.