Ford Mustang Mach-E autos at a Ford dealership in Colma, California, on July 22, 2022.

Bloomberg | Getty Photographs

After a house, shopping for a automotive is the costliest buy most customers will ever make throughout their lifetime. The transition to electrical autos by main auto makers is prone to make the method slightly extra annoying, at the least within the early days of the EV period when many customers are nonetheless under-informed on EV fundamentals. If customers are to be offered on the mass adoption of battery-powered electrical autos, automotive sellers are going to be important to the pitch. It is the community of franchise auto sellers who present schooling, service, and face-to-face gross sales, so firms like GM and Ford are working intently with them. But it surely’s a frightening second for each side of the automotive enterprise.

“We have not had a shift of this magnitude within the auto trade ever,” stated Robb Hernandez, president of Monterey Park, Calif.-based Camino Actual Chevrolet. “The bottom remains to be shifting beneath sellers making choices. The automakers are doing their finest making this shift, however the regulation is extra of the driving power of how we’ll all should pivot.”

That features his residence state of California, the place 100% of latest automotive gross sales are mandated to be EVs by 2035.

“I can solely converse for GM,” Hernandez stated. “They’re listening as we make these adjustments however the panorama is ever-changing at this level,” he stated. However he added, “Most auto sellers are optimistic and excited for the altering panorama.”

As of late final yr, 65% of Ford’s dealers had opted into the EV certification program (slightly below 2,000, in keeping with knowledge shared by Ford), because it has began to make the position of automotive sellers central to the EV transition course of.

Many customers desire a streamlined course of and nearly each transaction right now has some on-line part, in keeping with Brian Maas, president of the California New Automotive Sellers Affiliation. However with the sophisticated nature of a automobile buy transaction (trade-ins, financing, buy of prolonged warranties and different merchandise), a completely on-line expertise will solely work for a share of automotive consumers. “The remaining will nonetheless wish to ‘kick the tires’ and take a check drive earlier than investing $50,000+ within the common new automotive,” he stated.

This choice is anticipated to carry true for EVs. A latest report from the California Air Resources Board (CARB) cites “buyer alternative,” “automobile availability,” and “affordability” as keys to mass adoption, all of which require a vital position to be performed by sellers.

“I believe CARB understands that sellers are important to the adoption of EVs,” Maas stated.

He pointed to a number of components. First, and most evident, exterior of Tesla it’s franchised sellers who’ve to elucidate and promote this new know-how to the mass market. Second, all of the incentives adopted federally and in states corresponding to California are administered by or by way of sellers. And at last, EVs will not method affordability within the quick time period with out sellers making these funds out there to customers and explaining how these packages work on the level of buy.

Kerrigan Advisors, which works with dealership teams on gross sales and acquisitions, famous that Ford, relative to some high world opponents, has a comparatively giant dealership community to handle by way of the EV transition. “To some, Ford’s method is a technique to weed out the smaller sellers who’re unwilling to make the EV funding,” stated Erin Kerrigan, founder and managing director. “Consider Ford has over 3,000 franchises within the U.S.,” Kerrigan stated. “Against this, Toyota has only one,482 and sells extra autos than Ford.”

However she expects extra Ford sellers will choose in at a future date, as soon as they observe a significant client shift to EVs.

Timing of the EV transition is a priority

Whereas EV gross sales are rising quickly — as just lately as 2021, complete battery-powered electrical automobile gross sales within the U.S. had been below 450,000, however Kelley Blue E-book says gross sales surpassed 800,000 in 2022 and are anticipated to high a million this yr — sellers stay cautious concerning the timelines outlined by the auto firms.

“Regardless of vital will increase in EV gross sales in 2023, sellers are largely skeptical concerning the OEM’s timeframes on the EV rollout,” Kerrigan stated. “Many say they anticipate the rollout to take twice so long as anticipated and EV market share to be half as a lot as projected by the OEMs.”

Ford’s opt-in window will open once more in 2027 for sellers that didn’t initially be a part of.

Utilizing California as a mannequin — with its timeline being essentially the most aggressive – the method can start to really feel fairly squeezed, Maas stated.

“I wish to level out that that is essentially the most vital change in private transportation since we went from horses to vehicles early within the twentieth century. Along with altering how autos are powered (from ICE to BEV), we have now to offer the infrastructure for charging these autos and {the electrical} grid to assist such charging, and we have now to convey to customers that their driving habits should change,” he stated. The CARB 2035 aim is bold, and California is way additional alongside than some other state with an identical aim or contemplating adopting one, however “it is nonetheless a major leap,” Maas stated.

Sellers additionally learn the headlines and have considerations about OEMs with the ability to produce EVs on the tempo required by mandates, with uncooked supplies like lithium and cobalt in excessive demand and unsure provide. As large a supply-demand challenge is whether or not client curiosity shall be adequate to satisfy the mandate set by the state authorities in California for a full transition in 12 years. It’s a nationwide and state transition that in the end turns into an area choice.

Even inside California, a supplier in a rural space of the state the place EV charging infrastructure is a problem and the place public funding in charging shall be much less probably goes to be extra cautious than a supplier in a significant metro space within the state. A supplier in Santa Monica might resolve extra rapidly, “I have to be all-in on EVs,” Maas stated. “The place you stand relies on the place your corporation sits,” he stated. “Vital EV adoption in giant cities in California appears fairly clear now, however the query is will we have now vital EV adoption all through your entire state, will Eureka have it on the similar tempo as LA? Perhaps, possibly not?” Maas added.

Who pays for EV charging

The charging component of EVs, greater than some other issue, influences how a person’s day unfolds in a state like California the place two million new automobiles are offered yearly. Components embody automotive homeowners who reside in multi-family housing; and the time it might probably take to cost — as a lot as half-hour to a number of hours vs. lower than 5 minutes right now to fill a fuel tank on the many fueling stations with costs prominently posted and adjusted steadily.

“These challenges aren’t insurmountable, however we do have to elucidate them to customers, truthfully, in order that future automotive consumers are ready for what lies forward,” Maas stated.

To turn out to be “EV licensed,” Ford dealerships should buy right into a $500,000 tier or a $1.2 million tier, with the overwhelming majority of that funding tied to the expense of putting in EV charging infrastructure. On the decrease finish, this certification supplies sellers with restore and upkeep capabilities and a public DC quick charger, however no EVs to indicate within the showroom, and no entry to a Ford.com presence. It additionally caps their complete EV gross sales at 25% of stock. The “elite” tier supplies two public DC quick chargers, demo models, speedy replenishment, and a presence on Ford.com.

Ford CEO Jim Farley advised Automotive Information final December when it introduced that two-thirds of sellers had signed on for the EV program (most for the higher-priced tier), “The way forward for the franchise system hangs within the stability right here,” Farley stated. “The No. 1 EV participant within the U.S. wager towards the sellers. We wished to make the other alternative.”

However particular concerns from dealers, expressed to Ford, supply a window into the need on the a part of the sellers to additionally ask for deepening dedication from Ford as a part of their very own dedication to the e-certification program. One challenge has been supplier reluctance to supply public charging at their areas and asking Ford to up its personal funding in public charging, despite the fact that sellers are conscious the OEMs are spending billions on factories for brand spanking new EVs and batteries.

Sellers are ready to supply charging for brand spanking new autos to be offered on their lot and autos being serviced. However OEMs asking dealerships to function public charging stations has led to pushback. “Tesla pays for its supercharging community, sure with numerous taxpayer subsidies, however they pay,” Maas stated. “Sellers are within the enterprise of promoting and servicing automobiles, not promoting electrons,” he stated. Whereas future enterprise circumstances might show that sellers can earn money from charging, Maas famous that the promoting of electrons is closely regulated by public utility commissions throughout the nation. “Perhaps sellers simply wish to promote and repair automobiles,” he stated. “I have not been to a dealership that sells gasoline.”

Notably, Ford announced a deal with Tesla final week to make use of its charging community, which stunned some EV consultants given the aggressive nature of the market, but in addition positioned more pressure on GM to increase charging options.

Charging is a giant challenge, however not the one challenge for sellers.

“Whereas 24/7 public charging has maybe garnered essentially the most consideration, there are quite a few program options that we have now requested Ford to switch or remove,” Maas stated.

Dozens of state supplier commerce associations have challenged Ford on a number of elements of its EV certification program, together with its fundamental legality relative to state regulation about franchise fashions.

Auto makers reliant on the franchise mannequin have a monetary incentive to regulate extra of the margin that shall be out there within the EV market, and have discovered from watching the margin profile and high quality management loved by Tesla’s direct-to-consumer mannequin.

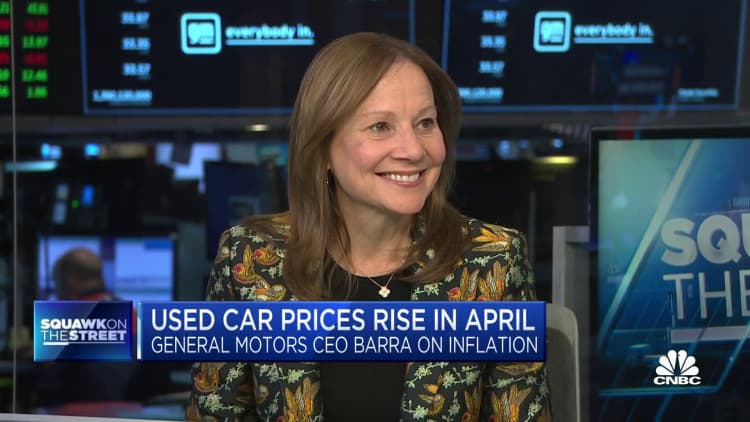

“We’ve got to alter our price profile,” Ford CEO Jim Farley told CNBC in February.

Ford’s method to promoting EVs in some methods is trying to mimic Tesla’s which supplies the corporate extra management over requirements from retailer to retailer than may be achieved by way of Ford’s traditional franchise model.

There may be at all times rigidity between franchisors and franchisees, and all states have franchise legal guidelines to attempt to stability the connection, and the place particular person sellers and supplier associations are pushing again is the place they really feel OEMs are utilizing the EV transition as a technique to make asks they by no means would have made beforehand. That isn’t restricted to charging, however OEM packages dictating how customers can reserve EVs, and prescribing how EVs should be offered, supplier trade-in packages, and repair contracts.

“Sellers usually chafe at producer necessities that intrude on their potential to promote to their clients,” Maas stated. “OEMs make automobiles and the supplier buys them at wholesale and the supplier sells. Why ought to that change as a result of it is powered by electrical energy? There’s nothing magic about the truth that it’s powered by electrical energy,” he stated.

Auto dealership gross sales market stays scorching

Kerrigan stated many of the sellers with whom she speaks do anticipate GM to ultimately have an identical program to Ford’s. In the meantime, GM is decreasing its supplier headcount by shopping for out present sellers. Within the case of Buick, GM is providing a franchise buyback for these sellers who don’t wish to make the EV funding. Cadillac has additionally “quietly diminished” its supplier depend by way of buyouts, Kerrigan stated. Versus Ford’s “pay-to-play” technique, she described GM’s present method as extra carrot than stick and, in decreasing franchise depend, guaranteeing the GM community is well-positioned to promote and repair EVs.

Sellers, although, might even see two sides to the methods each large OEMs are enjoying the EV transition. Ford, by giving sellers the choice to choose in later, shall be seen by some sellers who’re extra reluctant right now as being extra versatile, if requiring extra of an upfront funding right now. Some sellers might even see the GM method because the extra inflexible one, based mostly on their state of affairs. “Should you offered your retailer, there isn’t any altering your thoughts,” Maas stated. The OEMs are in a tough place trying to satisfy all supplier wants and considerations about EVs. “It is exhausting to have a nationwide program that’s one measurement suits all for the brand new automobile market,” he stated.

Within the short-term, the EV considerations will not be proving to be a giant think about general willingness amongst entrepreneurs to put money into automotive dealerships. Amid a giant soar in new and used automotive costs — the common new automotive retail worth elevated from $33,000 to over $46,000 between 2015 and 2023 — transactions within the auto supplier market had been the second-highest ever in 2022, in keeping with Kerrigan, with a file 845 franchises offered through the first three quarters of the yr. Whereas publicly traded auto retailers retreated from the market as their inventory market valuations had been reduce, personal consumers elevated their presence as earnings soared for the third-consecutive yr. Common dealership earnings rose 9% in 2022, which was 210% above the pre-pandemic five-year common.

“Even in a rising rate of interest atmosphere, sellers voted with their pocketbooks and grew their companies by way of acquisition in 2022 and proceed to take action in 2023,” Kerrigan famous in its April report on gross sales exercise.

Automotive dealership homeowners have confirmed to be an adaptive group of small enterprise homeowners all through historical past.

“Sellers are very resilient enterprise folks,” Kerrigan stated. “The demise of the auto retail enterprise mannequin has been erroneously predicted numerous occasions.”

She stated most will not be overly involved concerning the shift to EVs. Whereas some fear a few decline in fastened operations income from gross sales and repair as ICE automobiles disappear, others see the potential for increased income within the service and components division as sellers retain a better share of the customer support spend with EVs. Maas stated whereas there was quite a lot of discuss a service enterprise cliff associated to EVs, it is simply speak. “Service is just not going away,” he stated. In 2022, service contributed 12% of dealership income, in keeping with the Nationwide Auto Sellers Affiliation, versus practically 50% for brand spanking new automotive gross sales and 38% for used autos.

Sellers are gaining a bigger share of EV gross sales, totaling nearly 260,000 models in 2022, in keeping with NADA, and sellers capturing 35% of the brand new EV market by the tip of the yr. “We anticipate this to proceed as extra BEV fashions are launched by the legacy OEMs within the coming years,” NADA stated in its annual report.

“The neatest sellers try to determine the place that is going and make choices each for his or her household and funding within the enterprise,” Maas stated. “Finally, will probably be as much as customers to inform the sellers and OEMs and the bigger market what is going on to occur, as a result of if customers purchase these autos in big numbers it is a sign to the market we have to reply. But when they do not purchase on the tempo CARB has set, then some changes should be made.”