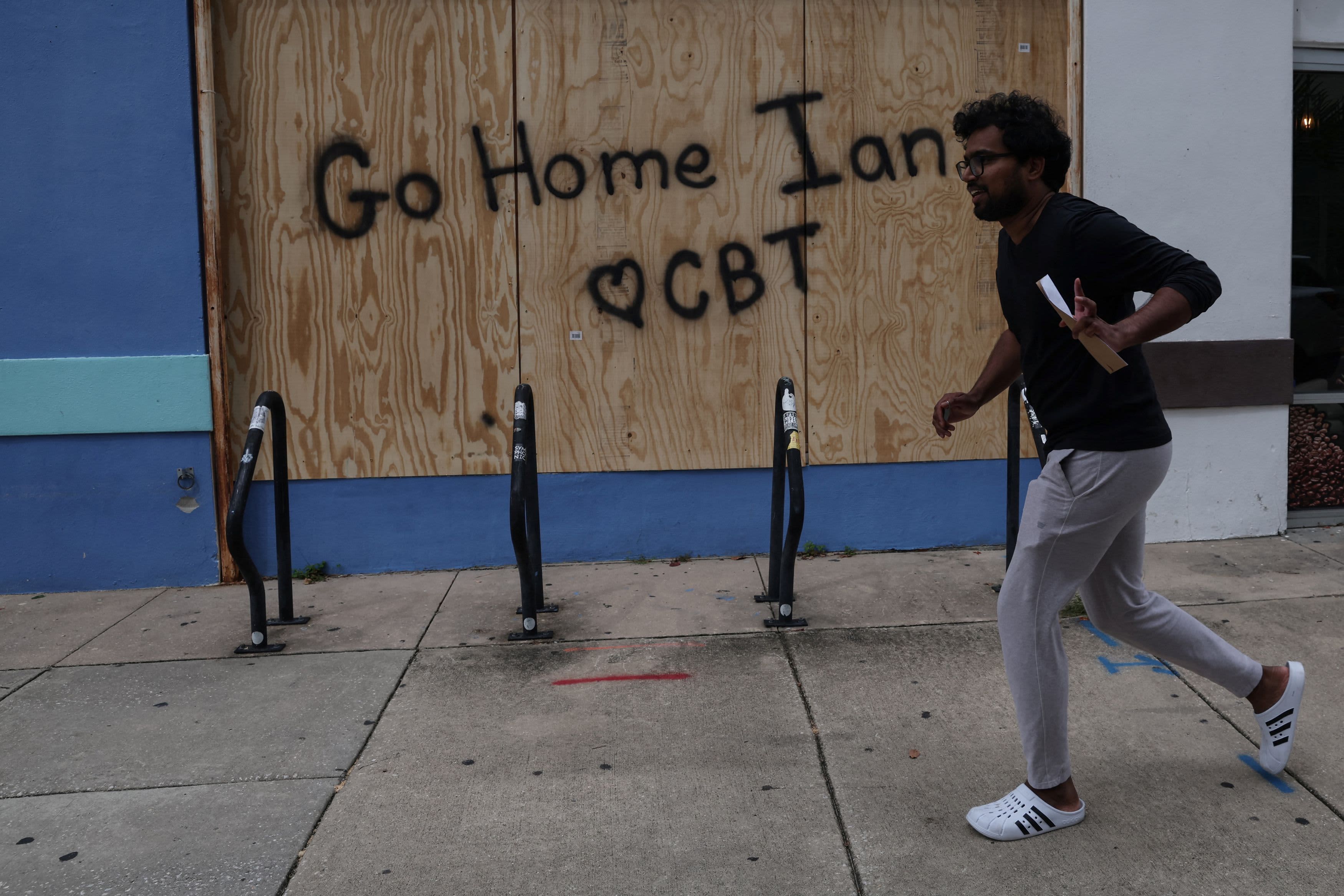

A person walks by means of the particles on a road within the aftermath of Hurricane Ian in Punta Gorda, Florida.

Ricardo Arduengo | Afp | Getty Photos

When you’re removed from the destruction brought on by Hurricane Ian in Florida, you could be thanking your fortunate stars that your home wasn’t within the storm’s path.

Nonetheless, you additionally could wish to take into account whether or not you are ready financially if catastrophe have been to hit nearer to house.

associated investing information

Whether or not you reside in an space liable to hurricanes, tornadoes, flooding, hail, wildfires or extreme storms — all of which appear to be changing into extra prevalent amid a warming local weather — it is vital to know which varieties of weather-related injury your owners insurance coverage covers, excludes or expenses a separate (and certain greater) deductible for.

Extra from Private Finance:

Here are some ways to trim your tax bill

How to get the best return on your cash

These resources can help struggling seniors

“Take time to grasp how the coverage [covers] extreme climate and pure disasters,” stated Steve Wilson, senior underwriting supervisor at insurer Hippo.

Ian was downgraded to a tropical storm on Thursday after slamming into Florida’s southwestern coast on Wednesday as a strong class 4 hurricane with sustained winds of about 150 mph. The storm might regain hurricane power because it heads into the Atlantic Ocean after which again towards the U.S. southeast shoreline, in accordance with the Nationwide Hurricane Middle.

It is value noting that earlier than Ian made landfall, the house insurance coverage market in Florida was in turmoil as a consequence of rampant roof alternative declare schemes and extreme litigation filed towards property insurers, stated Mark Friedlander, spokesman for the Insurance coverage Info Institute. In 2021, Florida owners noticed their premiums improve by a mean of 25%, in contrast with 4% for the remainder of the U.S.

“With a projected property injury loss in extra of $30 billion from Ian, we count on the market to turn out to be extra unstable,” Friedlander stated.

No matter the place you reside, here is what you need to evaluation in your owners insurance coverage coverage for weather-related protection.

Climate-related deductibles might be expensive

Whereas many weather-related occasions are coated beneath the usual a part of your coverage, some fall beneath a special part that comes with a separate deductible.

When you reside in a state alongside the East Coast or Gulf of Mexico, there is a good probability your coverage has a hurricane deductible. Likewise, in states extra liable to wind-related occasions — i.e., tornadoes — you are more likely to have a wind deductible.

Both method, these quantities sometimes vary from about 1% to five% (with a minimal $500) relying on the specifics of your insurance coverage. Some owners may go for a fair greater deductible if it is out there.

Bear in mind that for these percentage-based deductibles, the quantity relies in your insured worth, not the injury precipitated.

So if your property is insured for $500,000 and you’ve got a 5% hurricane deductible, you would be accountable for protecting the primary $25,000 whatever the complete value of the injury.

Additionally, earthquakes are usually not coated by commonplace owners insurance policies, even in quake-prone California (you’d should buy separate insurance coverage). Nor, sometimes, are different varieties of earth motion (i.e., landslides, sinkholes).

Do not overlook your flood threat

Flooding has turn out to be an rising threat for owners as sea ranges rise and storms develop bigger. But simply 15% of householders are insured to guard towards flood injury.

“One of the crucial vital insurance policies to contemplate for hurricane safety that may be neglected is flood insurance coverage,” Wilson stated.

In Florida, greater than 80% of householders don’t have flood insurance coverage, Friedlander stated. “With catastrophic flooding from Ian occurring throughout the state, many householders won’t have monetary safety from these losses,” he stated.

These owners will be capable to apply for grants from the Federal Emergency Administration Company, however the quantity sometimes solely covers a part of your loss. As an example, after 2017′s Hurricane Harvey, which dumped as a lot as 60 inches of rain in some spots in Texas, the common FEMA grant for people was $7,000, whereas the common declare by means of the Nationwide Flood Insurance coverage Program was greater than $100,000.

When you’re in a high-risk flood zone, your mortgage lender probably requires you to have flood insurance coverage. But 1 in 4 flood claims come from owners exterior of these areas, in accordance with FEMA.

You will get protection by means of both a non-public insurer or the federal program (which is how most householders get a coverage). There are exclusions and limitations on what is roofed, nonetheless. And, exterior of some exceptions, insurance policies take 30 days to turn out to be efficient.

The average yearly cost is $985, though that may differ extensively. FEMA not too long ago applied Threat Ranking 2.0, an actuarially sound strategy to higher assess particular person flood threat, which has precipitated premiums to rise for some owners and fall for others.