momcilog | E+ | Getty Pictures

It is nearly the time of 12 months for Medicare beneficiaries to think about to their 2023 Medicare plan.

This system’s fall open enrollment interval, when you can also make adjustments that take impact Jan. 1, begins Oct. 15 and runs by means of Dec. 7. This window is for protection associated to prescription drug plans (Half D) and Benefit Plans (Half C) — which means you’ll be able to add, swap or drop these elements of your protection.

If you are not required to do something — your 2022 protection usually would proceed into 2023 — it is however value checking to see in case your present plan would stay the best choice.

Extra from Private Finance:

High inflation may affect your tax bracket next year

Here’s why pumpkin spice lattes are so popular

These resources can help struggling older Americans

“Oftentimes there are adjustments, however they are often good or dangerous,” stated Ari Parker, a senior advisor at Chapter, a Medicare advisory agency. “Do not assume the adjustments will profit you.”

The upcoming window is also completely different out of your initial enrollment period, which begins three months earlier than your sixty fifth birthday and ends three months after it (seven months complete). That is whenever you usually should join Half A (inpatient care) and Half B (outpatient care) until you meet an exception resembling having acceptable protection elsewhere.

29 million are enrolled in Benefit Plans

Fall open enrollment touches most beneficiaries in a method or one other because of the protection they choose. For example, of Medicare’s 64.5 million beneficiaries (the vast majority of whom are age 65 or older), roughly 29 million select to get their Elements A and B advantages delivered by means of Benefit Plans, that are more likely to embody prescription drug protection. One other 20.5 million or so have standalone Half D plans.

Additionally remember that the upcoming enrollment interval will not be associated to Medicare complement plans, aka “Medigap,” which have separate guidelines for enrolling

Usually, until you reside in a state whose guidelines differ otherwise you meet an exception, you get a six-month window whenever you first enroll in Half B to buy Medigap with out having to reply well being questions and doubtlessly be penalized for pre-existing circumstances. After that, when you can usually enroll in these insurance policies at any time, you would be topic to medical underwriting and could possibly be rejected.

New Medicare provisions taking impact

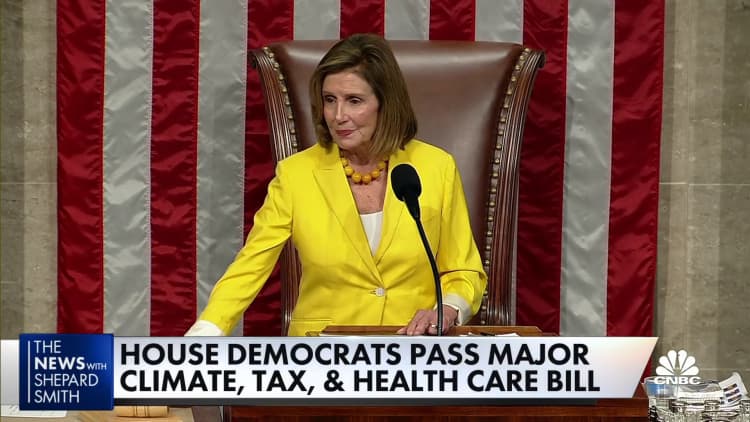

As you contemplate your 2023 protection, remember that a number of the Medicare-related provisions included within the lately enacted Inflation Discount Act take impact subsequent 12 months.

This features a monthly $35 cap on cost-sharing for insulin below Half D, which can begin on Jan. 1, in response to a spokesperson for the Facilities for Medicare & Medicaid Companies. (Some plans might already provide a $35 cap.) Half D deductibles additionally will not apply to the lined insulin product. For beneficiaries who take insulin by means of a standard pump (which falls below Half B), the profit begins July 1.

Moreover, there’ll not be any cost-sharing for advisable inoculations below Half D starting Jan. 1, together with the shingles vaccine.

Other provisions which are meant to scale back Half D spending take impact in later years. This contains eliminating an present 5% coinsurance within the so-called catastrophic part of protection (2024) and capping beneficiaries’ annual out-of-pocket Half D spending at $2,000 (2025). At the moment, there isn’t any out-of-pocket restrict, no matter whether or not you get your protection as a standalone Half D choice or by means of an Benefit Plan.

Medicare additionally will be capable to begin negotiating the worth of some medicine starting in 2026.

In the meantime, the usual monthly premiums for Part B will be $164.90 subsequent 12 months, down from $170.10 this 12 months. Beneficiaries with greater revenue pay extra by means of so-called revenue associated adjustment quantities, or IRMAAs, whether or not for Half B or D (see charts additional beneath).

Evaluation the prices, together with on your prescriptions

In the event you already are enrolled in an Benefit Plan or drug plan, you must have obtained (or you’ll quickly) a packet explaining adjustments to your protection for 2023. This might embody changes to month-to-month premiums, copays, deductibles, coinsurance or most out-of-pocket restrict, or adjustments to drug protection. Moreover, docs and different health-care suppliers fall on and off plans from year-to-year, as do pharmacies.

“It is essential for folks to ensure their suppliers are nonetheless collaborating of their plan for 2023 [and] their medicines might be lined on the most cost-effective worth doable,” stated Elizabeth Gavino, founding father of Lewin & Gavino and an impartial dealer and basic agent for Medicare plans.

“There’s nothing worse than discovering out on Jan. 1 that your medicines will now be costing you $1,000 extra per 12 months,” Gavino stated.

Bear in mind that when you can change your Benefit Plan early subsequent 12 months (Jan. 1 to March 31) should you uncover it is not a superb match, that is not the case for standalone Half D plans.

In the event you store for Benefit Plans throughout the upcoming fall enrollment, it’s possible you’ll discover they often are providing extra in the best way of additional advantages. Many plans additionally haven’t any premium (though you’ll nonetheless be accountable for your Half B premium).

Along with dental, imaginative and prescient and listening to or gymnasium membership, extras might embody issues like a credit score — say, $200 or $400 per 12 months — for over-the-counter medicines and different health-care provides; a Half B premium “buyback,” which suggests your plan rebates you a portion or your entire Half B premium; and transportation to and from physician’s appointments or different suppliers.

Nevertheless, whereas the added advantages will be interesting, it is essential to know that these extras can change from 12 months to 12 months, stated Danielle Roberts, co-founder of insurance coverage agency Boomer Advantages. And, she stated, you must make certain the plan meets your medical wants earlier than contemplating further advantages.

Benefit Plans additionally include out-of-pocket spending caps, not like authentic Medicare (solely Elements A and B). However these limits can differ amongst plans, as can deductibles and different cost-sharing, which makes it worthwhile contemplating these bills along with the month-to-month premium.

Be cautious of advertisements pushing plans

Additionally, In the event you contemplate enlisting the assistance of an agent or dealer, ensure they take the time to weigh all of the protection choices out there in your space from varied insurers. And assume twice earlier than responding to a TV business.

Medicare officers recently cracked down on aggressive and doubtlessly deceptive gross sales techniques from third-party entrepreneurs with some new guidelines, however you should still be uncovered to the tamer advertisements (or different gross sales efforts) and find yourself in a plan that would not have been the most suitable choice if all had been thought of.

“The commercials and cellphone calls will be arduous to disregard throughout this time of the 12 months, however be cautious of the advantageous print,” Roberts stated. “Many plans appear nice on the floor, however you will wish to have a look at all of the plan particulars earlier than enrolling.”