Underneath any situations, households do not like to stint in the case of the vacations.

However with rising costs and fears of a recession, vacation customers are feeling much less beneficiant this season.

Many shoppers are planning to make fewer purchases — and at a reduction, in line with a latest vacation retail report by Deloitte.

Nonetheless, households will shell out $1,455, on common, on vacation presents, in keeping with final 12 months, the report discovered.

Extra from Private Finance:

66% of workers are worse off financially than a year ago

Consumers prioritize Netflix, Amazon Prime over groceries, gas

Nearly half of Americans make this mistake with credit cards

Though some shoppers could find yourself spending as a lot or extra on their vacation purchasing as they did in 2021, that is largely resulting from increased costs, different experiences additionally present.

“Inflation is, by far, the largest difficulty for households this 12 months,” stated Tim Quinlan, senior economist at Wells Fargo and creator of Wells Fargo’s 2022 vacation gross sales report.

Family funds have taken a success with a decrease financial savings charge and declining real wages, which may sluggish vacation gross sales within the coming months, Quinlan stated within the report.

“The underside line is, with inflation remaining a headache, {dollars} aren’t stretching as far, and most shoppers will nonetheless be searching for bargains.”

{Dollars} aren’t stretching as far and most shoppers will nonetheless be searching for bargains.

Tim Quinlan

senior economist at Wells Fargo

A separate report by BlackFriday.com discovered that 70% of customers shall be taking inflation into consideration when purchasing this vacation season, and much more shall be looking out for offers.

Practically 33% of customers additionally plan to purchase fewer presents this 12 months, whereas roughly one-quarter stated they might go for cheaper variations or extra sensible presents, corresponding to gasoline playing cards, in line with TransUnion’s vacation purchasing survey.

“Individuals are attempting to economize and benefit from what they’ve,” stated Cecilia Seiden, vice chairman of TransUnion’s retail enterprise.

How you can keep away from vacation debt

“Keep in mind to not put your self in debt over vacation purchasing,” cautioned Natalia Brown, chief consumer operations officer at Nationwide Debt Reduction. “Debt prevents folks from reaching their monetary objectives — like constructing an emergency fund, shopping for a house and saving for retirement.”

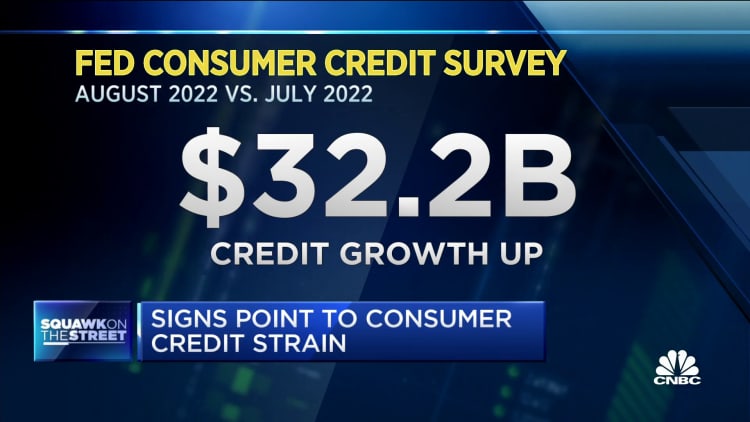

Vacation spending may come at the next value if it means tacking on extra bank card debt simply because the Federal Reserve raises rates of interest to sluggish inflation, Quinlan added.

Annual proportion charges are at the moment close to 18%, on common, however could possibly be nearer to 19% by the tip of the 12 months, which might be an all-time high, in line with Ted Rossman, a senior business analyst at CreditCards.com.

That can go away shoppers worse off heading into 2023, Quinlan stated. “In some ways we view this 12 months’s vacation purchasing season because the final hurrah.”