Chris Ryan | Getty Photos

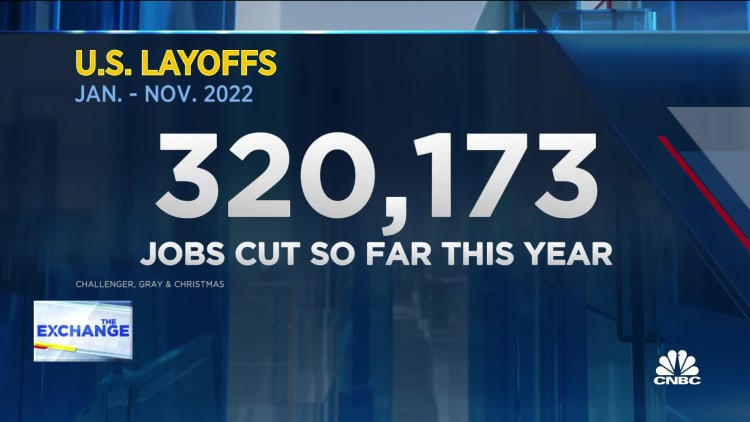

Buyers are bracing for 2023 amid inventory market volatility, rising rates of interest and geopolitical threat — with many carrying recession fears into the brand new yr.

However regardless of financial uncertainty, monetary consultants level to well timed alternatives, urging buyers to place money into the market, reasonably than leaving it on the sidelines.

Agreeing with many within the advisor group, Betterment CEO Sarah Levy stated she expects a “turbulent and risky first half of 2023,” however her long-term outlook is optimistic.

“Over a five- and 10-year horizon, this can be a nice second for that dollar-cost averaging alternative,” she stated, talking at CNBC’s Financial Advisor Summit on Tuesday.

Extra from Private Finance:

4 key year-end moves to ‘control your tax reporting destiny’

Supreme Court likely to rule Biden student loan plan is illegal

Amid inflation, parents are paying for Gen Zers’ travel this holiday

The technique behind dollar-cost averaging is placing your cash to work by investing at set intervals over time, no matter what occurs available in the market.

Whereas analysis exhibits investing a lump sum sooner may offer higher returns, some consultants say dollar-cost averaging might assist forestall emotional investment decisions.

After double-digit losses in 2022 for each the inventory and bond markets, it is simple to see why some could also be hesitant to proceed investing. However consultants say the fear of loss can be costly, and chances are you’ll miss the market’s best recovery days.

The ten greatest days over the previous 20 years occurred after huge declines in the course of the 2008 monetary disaster or the pullback in 2020, in keeping with an evaluation from J.P. Morgan.

“Take management of the issues you’ll be able to management,” Levy stated, noting that automated, recurring investments might help “take the emotion out of the equation,” when the markets dip, she stated.

There are alternatives for money as rates of interest rise

At present, shoppers have $1.5 trillion in excess savings from the Covid pandemic, however are spending 10% greater than in 2021, and “inflation is eroding all the things,” JPMorgan Chase CEO Jamie Dimon stated Tuesday on CNBC’s “Squawk Box.”

Nonetheless, rising rates of interest have made high-yield financial savings accounts extra engaging, Levy stated. Buyers might profit in the event that they’re conserving cash on the “proper establishments” the place increased yield is being handed alongside to the patron, she stated.

“Cash in a financial savings account is accessible capital,” Levy stated. “There actually is not any profit to locking cash up with any type of period.”