Michael Godek | Second | Getty Photos

Three years after the Safe Act of 2019 ushered within the first main adjustments to the U.S. retirement system in additional than a decade, extra modifications at the moment are on their approach.

Dozens of retirement-related provisions collectively generally known as “Safe 2.0” are included in a $1.7 trillion omnibus appropriations invoice that obtained approval from the Home on Friday — following the Senate’s nod on Thursday — and can head to President Joe Biden for his signature.

Safe 2.0 “addresses gaps which have left some folks on the sidelines of retirement financial savings, unable to entry the office retirement plans that achieve this a lot good in establishing the potential and behavior of financial savings,” stated Susan Neely, president and CEO of the American Council of Life Insurers.

Extra from Private Finance:

Here are 10 ways to avoid the early withdrawal penalty for IRAs

Wells Fargo settlement includes $2 billion for wronged customers

These are the 10 best metro areas for first-time homebuyers

“Half-time employees, navy spouses, small-business staff, and pupil mortgage debtors are just some who will profit and have a greater likelihood of positioning themselves for a extra financially safe retirement on account of Congress’s motion right this moment,” Neely stated.

The Safe 2.0 provisions are meant to construct on enhancements to the retirement system that have been carried out underneath the 2019 Secure Act. These adjustments included giving part-time employees higher entry to retirement advantages and rising the age when required minimum distributions, or RMDs, from sure retirement accounts should begin — to age 72 from 70½.

This time round, a number of the many provisions which can be within the huge appropriations invoice embrace:

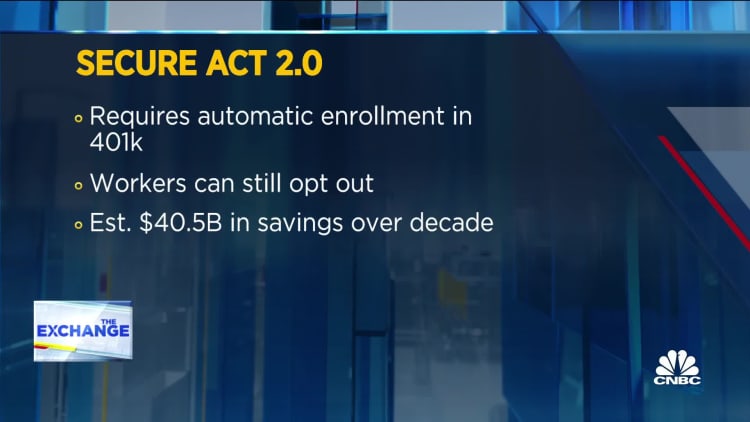

- Requiring computerized 401(ok) enrollment: Employers can be required to mechanically enroll staff of their 401(k) plan at a price of least 3% however no more than 10%. Companies with 10 or fewer employees and new corporations in enterprise for lower than three years are amongst people who can be excluded from the mandate.

- Rising the age when RMDs would wish to start out: The present invoice would enhance it from age 72 to age 73 in 2023 after which to age 75 in 2033. Moreover, the penalty for failing to take RMDs can be lowered to 25%, and in some circumstances, 10%, from the present 50%.

- Creating larger “catch-up” contributions for older retirement savers: Beneath present regulation, you possibly can put an additional $6,500 yearly in your 401(ok) when you attain age 50. Safe 2.0 would enhance the restrict to $10,000 (or 50% greater than the common catch-up quantity) beginning in 2025 for savers ages 60 to 63. Catch-up quantities additionally can be listed for inflation. Moreover, all catch-up contributions will likely be topic to Roth remedy (i.e., not pretax) apart from employees who earn $145,000 or much less.

- Broadening employer 401(ok) match choices: A proposal would make it simpler for employers to contribute to 401(ok) plans on behalf of staff paying student loans as a substitute of saving for retirement.

- Enhancing employee entry to emergency financial savings: One provision would let staff withdraw as much as $1,000 from their retirement account for emergency expenses with out having to pay the standard 10% tax penalty for early withdrawal if they’re underneath age 59½. Corporations additionally might let employees arrange an emergency financial savings account via computerized payroll deductions, with a cap of $2,500.

- Rising part-time employees’ entry to retirement accounts: The unique Safe Act made it so part-time employees who ebook between 500 and 999 hours for 3 consecutive years could possibly be eligible for his or her firm’s 401(ok). Safe 2.0 reduces that to 2 years. Corporations have already got been required to grant eligibility to staff who work at the very least 1,000 hours in a yr.

- Serving to employees who’re repaying pupil loans save for retirement: Safe 2.0 makes it simpler for employers to contribute to 401(ok) plans (and comparable office plans) on behalf of staff who’re making pupil mortgage funds as a substitute of contributing to their retirement plan.

- Boosting how a lot may be put in a certified longevity annuity contract: At the moment, the utmost that may go right into a QLAC is both $135,000 or 25% of the worth of your retirement accounts, whichever is much less. Safe 2.0 eliminates the 25% cap and will increase the utmost quantity allowed in a QLAC to $200,000.

- Altering the required minimal distribution guidelines for Roth 401(ok)s: At the moment, whereas Roth IRAs include no RMDs through the authentic account proprietor’s life, that is not the case for Roth 401(ok)s. Beginning in 2024, the pre-death distribution requirement can be eradicated.

- Broadening makes use of for unused faculty financial savings cash: A provision would permit for tax- and penalty-free rollovers to Roth IRAs from 529 college savings accounts which can be at the very least 15 years previous, inside limits.

- Serving to navy spouses get entry to retirement plans: Safe 2.0 creates tax credit for small companies that allow navy spouses enroll immediately of their plan and qualify for instant vesting of any employer matches.

The invoice additionally contains incentives for small companies to set up retirement savings plans for his or her employees, encourages people to put aside long-term financial savings and makes it simpler for annuities to be an earnings choice for retirees.