Inflation is just too excessive and the central financial institution wants to maneuver faster to get it underneath management by elevating rates of interest, mentioned Gilbert Garcia, a managing associate at Garcia Hamilton & Associates in Houston.

“I wanted we might retire the phrase ‘transitory,'” Garcia mentioned, on the CNBC Monetary Advisor Summit on Wednesday, talking of predictions that the current rise in costs are non permanent.

“Inflation is operating at 6%, most likely properly over 6%, irrespective of the way you take a look at it,” he added. “It is fairly clear that it is longer than transitory and it is a lot hotter than their inflationary goal.”

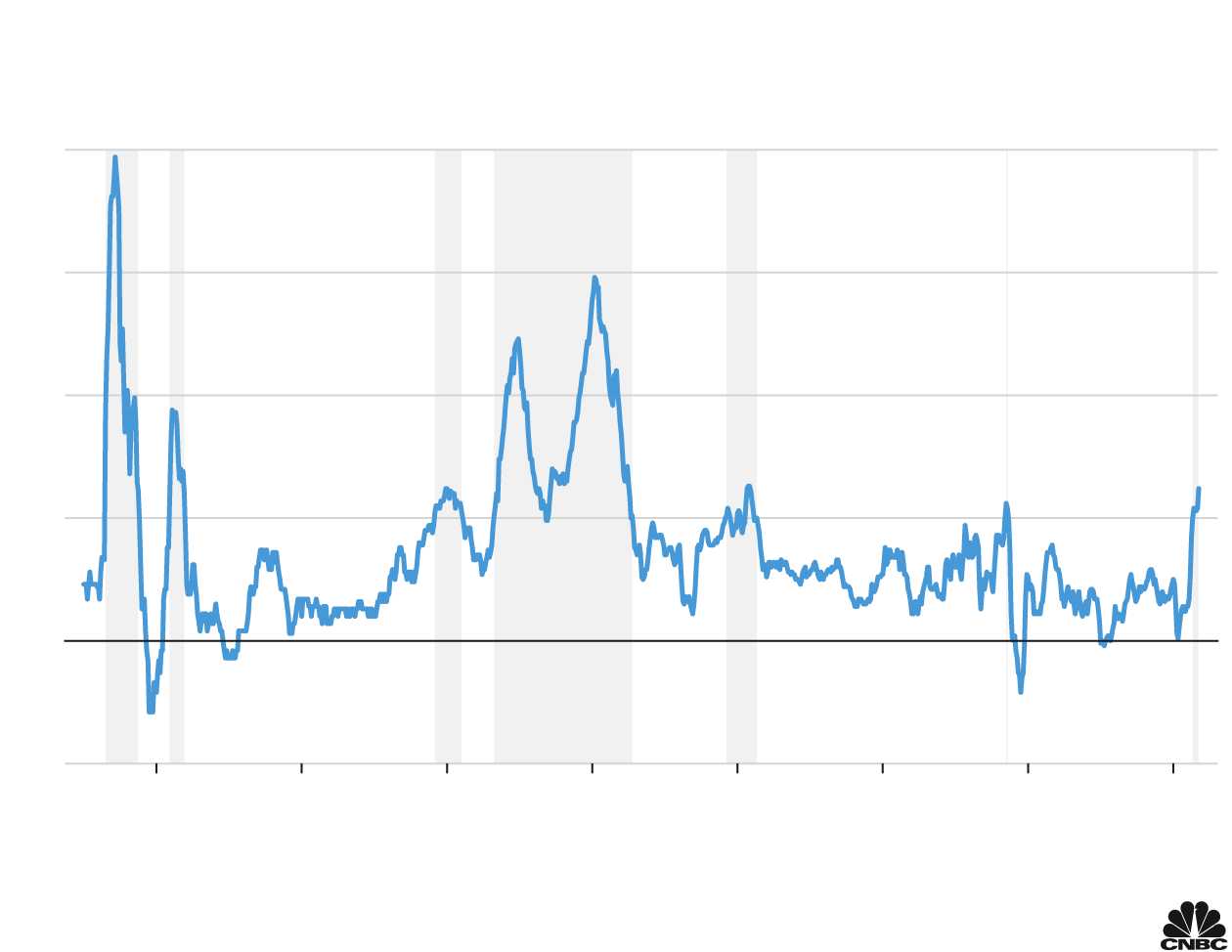

Episodes of U.S. inflation

Client worth index, % change from a 12 months in the past

Notice: Durations of heightened inflation are shaded.

Supply: Bureau of Labor Statistics (CPI), White Home (inflationary intervals by way of ‘08). Information is

seasonally adjusted and as of Oct. ’21.

Episodes of U.S. inflation

Client worth index, % change from

a 12 months in the past

Late 1960’s financial growth

Notice: Durations of heightened inflation are shaded.

Supply: Bureau of Labor Statistics (CPI), White

Home (inflationary intervals by way of ‘08).

Information is seasonally adjusted and as of Oct. ’21.

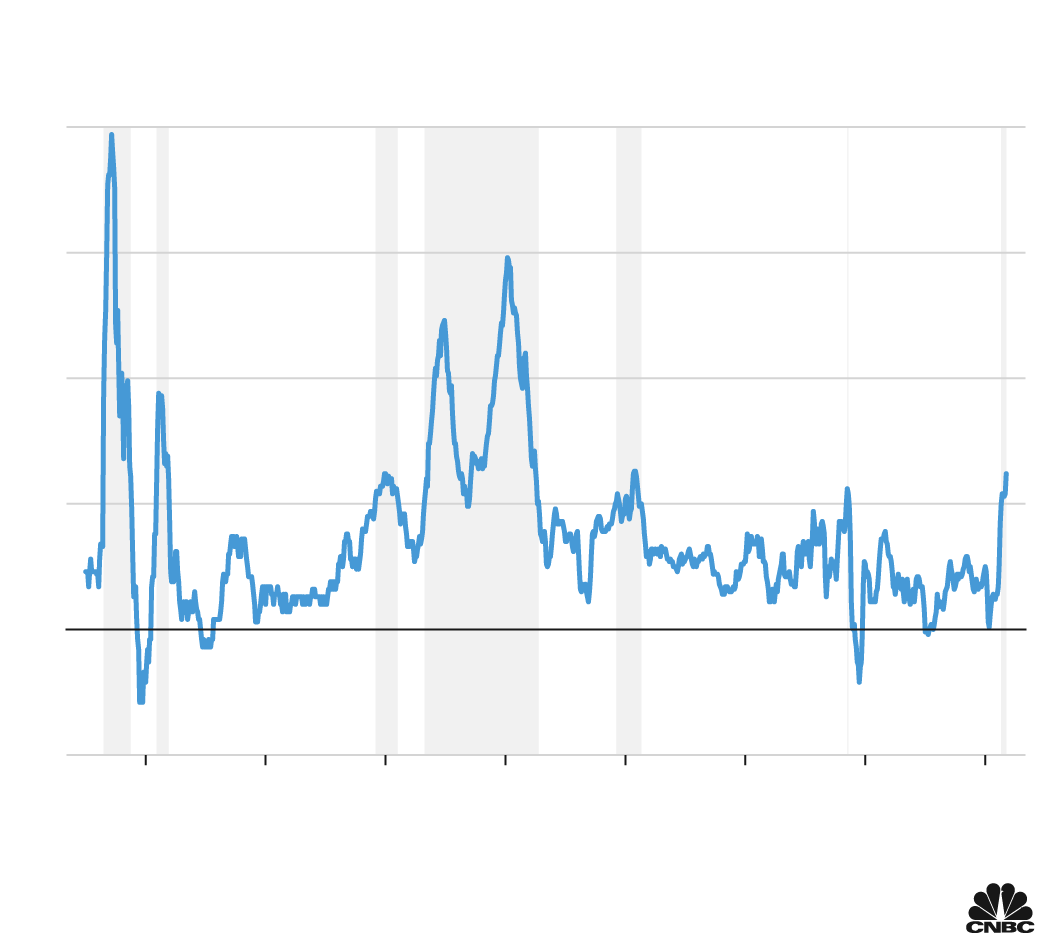

Episodes of U.S. inflation

Client worth index, % change from a 12 months in the past

Notice: Durations of heightened inflation are shaded.

Supply: Bureau of Labor Statistics (CPI), White Home (inflationary intervals by way of

‘08). Information is seasonally adjusted and as of Oct. ’21.