A view of the Exxon Mobil refinery in Baytown, Texas.

Jessica Rinaldi | Reuters

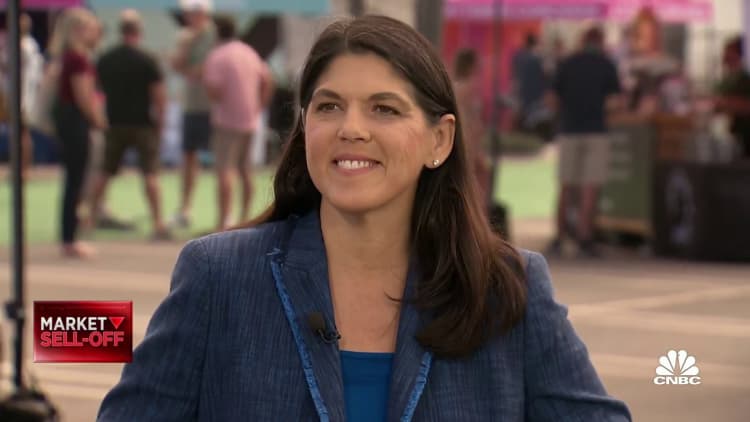

Jennifer Grancio was among the many leaders at Engine No. 1, the upstart investing agency centered on local weather and power transition, that bested ExxonMobil in a 2021 proxy contest upset few noticed coming. What Engine No. 1 determined to do subsequent was perhaps as shocking: transfer away from the activist investor method that labored so effectively in profitable board seats on the oil and gasoline big.

Now CEO, Grancio would not need the agency to be outlined by the Exxon headline, however somewhat by a long-term investing method that may be a blueprint for a way firms ought to take into consideration big methods adjustments like power transition, and the way buyers ought to entry the worth that can be created by the businesses that get it, and scale reworked companies.

“Investing is one thing you are able to do for the very short-term, however for the overwhelming majority of asset homeowners … they’re all on the lookout for efficiency over time,” Grancio stated on the CNBC ESG Impression digital occasion on Thursday. “The market can get confused about investing just for ideology or the extraordinarily short-term, however Engine No. 1 goes deep with firms, trying primarily on the enterprise mannequin and the way it might want to change over time to create worth for shareholders.”

The ExxonMobil marketing campaign does hit on the large themes: having the proper governance in place to see firms by means of large methods adjustments, making the proper investments and avoiding the improper ones. “We bought into Exxon as an investor as a result of we knew whether it is sensible and has the proper administration for power transition and the way the enterprise is valued after power transition, that can be nice for shareholders,” she stated. “We consider the ExxonMobil marketing campaign as being about governance and long-term capitalism,” she stated.

Grancio shared just a few of her foundational concepts for investing sooner or later and staying forward of the market at ESG Impression.

A lot of expertise, however not tech shares

“As buyers, we like to speak about Google and Amazon, however the place the returns will actually be generated within the subsequent decade, we glance to agriculture, autos and power,” Grancio stated.

Engine No. 1 is doing lots of work with autos, which it has been public about, together with an funding in GM, on what she describes as a long run transition.

“Individuals find out about Tesla, however they overlook about GM and Ford,” Grancio stated.

“We can have this big transition and it wants scale, and that is thousands and thousands and thousands and thousands of vehicles and there may be big room for incumbents like GM and Ford to be a part of creating and assembly all of this demand,” she stated. This doesn’t suggest Tesla will not be a winner, she added, however GM and Ford additionally can be, Grancio stated.

Do not simply be an index fund investor

Engine No. 1 has a passive index ETF — Grancio was among the many senior leaders of the BlackRock iShares ETF enterprise earlier than becoming a member of Engine No. 1 — however she warns buyers that in the identical means they could deal with Tesla and overlook about the remainder of the auto sector, they may miss out on large funding alternatives in the event that they stick to the index portfolio weightings.

“Should you go away your cash in a passive index fund, otherwise you solely purchase the super-growth shares, you should have an enormous drawback in your portfolio,” she stated. “Traders are underweight the large transition concepts if they’re within the indexes,” she added.

Grancio stated holding the market in an index fund permits buyers to make use of their shareholder voting energy to drive outcomes, which it did by banding along with many massive institutional shareholders to tackle Exxon, however most of the largest transition performs, from power to transportation, are underweights for almost all of buyers due to index fund use.

One other large instance she cited is agriculture, and an organization that she stated is getting it proper: Deere. “It makes tractors and tractors are soiled, but when we flip that and take into consideration impression and the worldwide meals disaster and fixing it, Deere’s moves into precision ag are higher for local weather and yield and monetary efficiency of farmers,” she stated. Deere is constructing a enterprise to resolve an enormous systemic drawback which additionally has an impression investing perspective, she stated.

Nonetheless investing in large oil, and anticipating power transition to take a ‘little longer’

Grancio says that Engine No. 1’s work with Exxon is an indication that ESG investing works. “Have a look at the appreciation of various firms in power and Exxon has greater than doubled, considerably larger than friends, and it wasn’t simply the worth of oil,” she stated.

She additionally cited Oxy (previously Occidental Petroleum) which has been a pacesetter within the power transition area and has greater than doubled in 2022 “as a result of it’s totally different from friends,” she stated. “We consider these are essentially funding points,” she added. One other essential issue that made Oxy totally different from friends: a massive investment made by Warren Buffett within the firm.

Engine No. 1 continues to be an energetic proprietor of power firms, engaged on most of the identical points that it did at Exxon even when not by means of a proxy battle: managing capital allocation, setting clear targets on emissions, and investing in inexperienced power enterprise.

However she says that the final yr throughout which the worth of oil spiked because of the battle in Ukraine and important power shortages in Europe have been uncovered does imply that the power transition “will in all probability be a bit of bit longer.”

“Individuals use fossil fuels and we’ve got not made this transition, and if we’d like fossil gasoline property we’d like them to be managed by the most important firms in a means that can be new applied sciences to take care of worth after the transition, once we can be extra in want of renewables and carbon seize,” she stated.

That is why she continues to see large power firms as an funding alternative. “They know easy methods to do this stuff at scale. We have to ship power to the world as we speak, however as we get to the opposite facet of the power transition, how they cope with these points can be required for them to nonetheless have an incredible enterprise,” she stated. “We expect there may be lots of room to work constructively with firms on these points.”

US reshoring of producing ought to be a brand new focus

Whereas it doesn’t match neatly into an ESG field like local weather, Grancio stated one of many largest funding alternatives sooner or later that she is chasing can be American firms in manufacturing, transportation and logistics tied to an enormous resurgence in home manufacturing and manufacturing.

“Traders aren’t holding railroads, not assuming vehicles or chips can be made within the U.S.,” she stated.

On Thursday, President Biden touted a plan by IBM to speculate $20 billion in New York-based chip manufacturing, two days after Micron Technology introduced up to $100 billion in semi manufacturing investments within the state.

With out offering particulars, she stated Engine No. 1 can be creating an funding sooner or later across the alternative to put money into the U.S. provide chain. “We’ll be doing one thing,” she stated.

The U.S. home manufacturing revival is, in a way, type of “methods change,” as globalization of prior a long time is disrupted. And that matches Engine No. 1’s general self-discipline. “We actually suppose it’s a must to perceive methods and corporations at a deep stage to make good decisions. Investing ought to by no means be ideological. It ought to be about understanding these firms and the way industries are altering,” she stated. And at a time of serious political blowback against ESG investing centered totally on power firms and local weather change, she added, “Hopefully, we do not let theater get in the way in which on this.”