With lingering excessive inflation, inventory market volatility and recession fears, it is simple to see why some Individuals may trim charitable giving.

However some donors could also be eyeing greater presents for 2022 due to that financial uncertainty, in response to a study from Constancy Charitable, a nonprofit enabling buyers to provide by means of a so-called donor-advised fund, a charitable funding account.

Almost 75% of these surveyed mentioned they fear about different group members, and 64% are involved about nonprofits amid threats of a recession. Consequently, 59% of donors could also be keen to provide extra this 12 months, in response to the survey, which polled 969 of the nonprofit’s donors in July and August.

Extra from Private Finance:

The best time to apply for college financial aid is coming up

What the Fed’s third 75 basis point interest rate hikes mean for you

Benchmark bond yields are ‘bad news’ for investors as the Fed hikes rates

Particular person Individuals donated an estimated $326.87 billion to charity in 2021, a 4.9% rise in comparison with the prior 12 months, in response to Giving USA.

Whereas the group predicted “a sturdy 12 months” for giving in 2022, it additionally emphasised the hyperlink between philanthropy and the energy of the inventory market. The report got here out because the inventory market approached file highs in December, however the S&P 500 has dropped greater than 20% year-to-date.

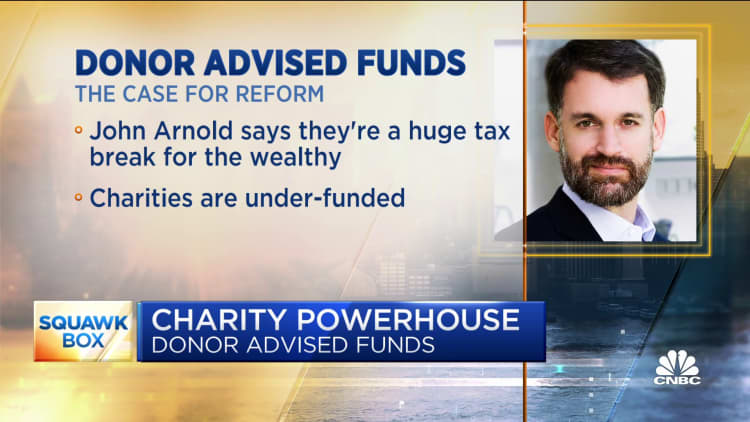

Donor-advised funds could make it simpler to provide

Whereas some donors could also be uncertain about 2022, it could be a neater selection if you have already got cash in a donor-advised fund, permitting an upfront donation and the choice to choose recipients over time, mentioned licensed monetary planner David Foster, founding father of Gateway Wealth Administration in St. Louis. A donor-advised fund is a charitable account for future presents.

“You’ve got already made that call,” he mentioned. “Now it is only a matter of doing it a little bit faster.”

Certainly, 67% of donors mentioned they’ve given extra to charity than they might have with no donor-advised fund, the Constancy Charity examine reveals, and 57% have used their account to “reply to an emergency or catastrophe state of affairs.”

Nevertheless, if somebody did not switch cash upfront, new donations for 2022 could also be smaller than earlier years as a consequence of much less earnings or decrease account balances.

“From my expertise, individuals are nonetheless giving roughly the identical share of both their earnings or their wealth,” mentioned Foster. “It is simply that their incomes and wealth are down due to the economic system.”

“There’s simply much less wealth to provide,” he added.

Whereas donor-advised funds are a well-liked possibility, older buyers can also think about so-called qualified charitable distributions, or QCDs.

These are direct presents from an IRA to an eligible charity. Should you’re age 70½ or older, it’s possible you’ll donate as much as $100,000 per 12 months, and it could rely as a required minimum distribution when you flip 72.

“There are comparatively few circumstances the place that may not be the primary supply of giving if you happen to’re over 70½,” Foster mentioned.

Though QCDs do not present a charitable deduction, the switch will not rely as a part of your adjusted gross earnings, which might set off larger Medicare Half B and Half D premiums.