Halfpoint Photos | Second | Getty Photos

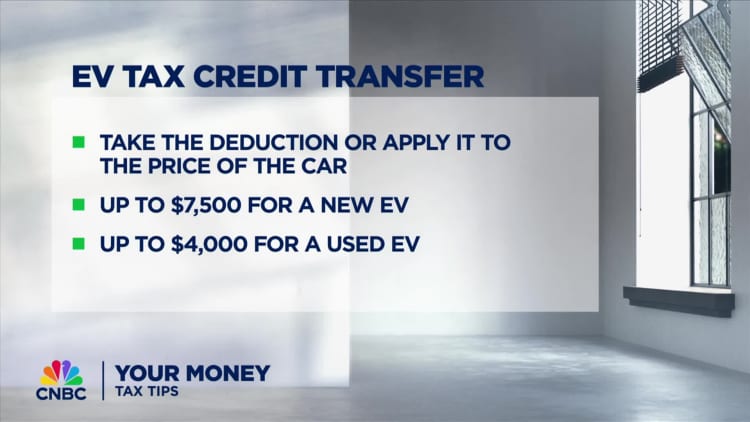

Shoppers not have to attend to file their annual tax returns to get a tax break for the acquisition of a brand new electrical car.

In the beginning of 2024, the federal “new clean vehicle” tax credit score turned out there as a point-of-sale low cost — price as much as $7,500 — at automobile dealerships.

Meaning collaborating sellers may give eligible shoppers a direct break on an EV’s buy value, maybe through a partial cost or down cost on the car or a money cost to patrons.

Consumers of used EV fashions are additionally eligible for an upfront value low cost from sellers. That tax break for a “beforehand owned clear car” is price as much as $4,000.

Previous to January, automobile patrons needed to wait till tax season the 12 months following their buy to assert these tax credit.

Apart from that delay, ready till tax season carried a further monetary hurdle for shoppers as a result of the worth of their whole EV tax credit score could not exceed their annual tax legal responsibility, because the credit score is “nonrefundable.”

That meant many shoppers — particularly decrease earners, who are inclined to have smaller tax payments — did not qualify for the total $7,500.

Now, collaborating automobile sellers can cross alongside the credit score’s full worth no matter a family’s tax legal responsibility, as long as the client and car meet different eligibility standards.

“It has so many advantages,” Ingrid Malmgren, coverage director at Plug In America, stated of the brand new guidelines. Plug In America is non-profit academic group.

Shoppers can nonetheless choose to obtain the monetary profit at tax time as an alternative of receiving it as an advance cost of the tax credit score.

Gross sales reviews submitted to the IRS point out greater than 70% of shoppers have used the upfront choice up to now in 2024, in response to Jan. 31 remarks from Lily Batchelder, assistant secretary for tax coverage on the U.S. Treasury Division.

U.S. electrical car gross sales hit a file 1.2 million in 2023, up 46.3% from 2022, according to Kelley Blue E book.

The common shopper paid $50,798 for a brand new EV in December, down 17.7% from January 2023, Kelley Blue E book stated. (That price consists of monetary incentives.) By comparability, the common transaction value for all new autos in December was $48,759.

Not all EV sellers are collaborating but

Maskot | Maskot | Getty Photos

The Inflation Discount Act, a landmark U.S. regulation to deal with local weather change, turned the EV tax credit into an upfront discount beginning in 2024 by making a so-called “switch” provision.

Shoppers can select to switch the worth of their tax credit score to a automobile seller, which might then be reimbursed by the IRS for fronting that cash to shoppers. The quantity supplied by sellers should equal the total quantity of the tax credit score out there for the eligible car, in response to the Treasury Division.

Sellers should enroll through the IRS Energy Credits Online portal to facilitate these transfers. The Treasury opened registration to sellers and automobile producers in November.

Not all automobile sellers have but signed up. Meaning qualifying shoppers who need an upfront EV low cost could not be capable of get one, relying on their vendor.

As of Feb. 6, greater than 11,000 sellers had registered within the IRS portal, in response to a Treasury official talking on background. Of these, 74% — greater than 8,200 — are registered to make advance funds of transferred clear car credit to shoppers, the official stated.

(These two figures differ for a couple of causes, the official stated. For one, there is a minimal 15-day ready interval for sellers to have the ability to present point-of-sale reductions after registering. The IRS should additionally conduct guide opinions in some instances.)

For context, there have been 16,839 franchised retail automobile sellers within the U.S. throughout the first half of 2023, according to the Nationwide Vehicle Sellers Affiliation.

There are additionally roughly 60,000 impartial automobile sellers, which largely promote used automobiles, according to a 2021 Cox Automotive estimate.

Nevertheless, not all franchises or impartial sellers essentially promote EVs.

Not all EVs are eligible for a tax credit score

And never all EVs are eligible for a tax break.

The Inflation Discount Act has manufacturing requirements for new EVs that restrict (briefly, almost definitely) the fashions that qualify for a full or partial tax break. Sellers who promote non-qualifying fashions haven’t got an incentive to but join IRS Vitality Credit On-line, Malmgren stated.

There are 27 new EV fashions at the moment out there for a full or partial tax break in 2024, according to the U.S. Vitality Division. They’re manufactured by Chevrolet, Chrysler, Ford, Jeep, Lincoln, Rivian, Tesla and Volkswagen.

At current, there’s not a database the place shoppers can seek for automobile sellers which have registered to supply a point-of-sale EV low cost, Malmgren stated.

“There’s probably not any technique to know, except it is listed on the seller’s web site or for those who name a seller,” she stated.

Shoppers can ask respective sellers in the event that they’re registered with the IRS to supply the point-of-sale tax credit, Malmgren added. Phrased in another way, they will additionally inquire if the seller gives advance funds of the $7,500 EV tax credit score or a transferrable EV tax credit score, she stated.

Be careful for pitfalls

Not all shoppers qualify for a tax break, both.

The EV tax credit score carries some eligibility requirements for shoppers. Family revenue should fall under sure thresholds, for instance. The necessities fluctuate for brand new and used EV purchases.

Consumers might want to signal an affidavit at automobile dealerships affirming their annual revenue would not exceed sure eligibility thresholds. Making an error would usually require shoppers to repay the tax break to the IRS.

Consumers should file an revenue tax return for the 12 months during which they switch their EV tax credit score to a seller. Consumers ought to make certain to get a replica of a efficiently submitted vendor report from their automobile seller, which shoppers would then file with their tax return, Malmgren stated.