Singapore expertise ride-sharing and meals supply service firm Seize emblem is displayed on a smartphone display.

Budrul Chukrut | Sopa Photographs | Lightrocket | Getty Photographs

Singapore-based ride-hailing and meals supply big Grab narrowed losses and broke even in its deliveries section for the primary time since 2012, through the third quarter.

The corporate posted an adjusted earnings earlier than curiosity, taxes, depreciation and amortization lack of $161 million, a 24% enchancment from the adjusted EBITDA lack of $212 million in the identical interval a 12 months in the past. EBITDA is a measure of profitability that reveals earnings earlier than curiosity, taxes, depreciation and amortization.

associated investing information

Seize presents a spread of providers together with ride-hailing, meals supply, package deal supply, grocery supply and cell funds via GrabPay.

The corporate stated its supply enterprise broke even three quarters forward of expectations, “primarily because of optimization of our incentive spend, and contributions from Jaya Grocer.” In January, Seize acquired a majority stake in Malaysian mass-premium grocery store chain Jaya Grocer to speed up its enlargement into grocery supply.

Meals deliveries additionally reported constructive adjusted EBITDA within the third quarter, two quarters forward of its earlier steering.

“We achieved core meals deliveries and general deliveries segment-adjusted EBITDA breakeven forward of steering whereas narrowing our general loss for the interval considerably. We completed this by staying laser-focused on our value construction and incentive,” Anthony Tan, Seize co-founder and group CEO, stated in a press release.

U.S.-listed shares of Seize rose 0.64% to shut at $3.15 a bit in Wednesday commerce, outperforming the S&P 500 and Nasdaq Composite which declined 0.83% and 1.54%, respectively.

Seize went public in December 2021 after closing its SPAC merger. The inventory has plummeted 56% 12 months to this point.

Driving towards profitability

Seize’s month-to-month common energetic driver-partners within the quarter hit 80% of pre-Covid ranges. The corporate additionally stated incentives declined to 9.4% of GMV, in contrast with 11.4% for a similar interval final 12 months and 10.4% for the earlier quarter.

“This demonstrates our dedication to rising profitably and sustainably,” stated Tan.

Seize raised its full-year forecast and now expects income between $1.32 billion and $1.35 billion, up from the earlier vary of $1.25 billion to $1.30 billion. It additionally revised its adjusted EBITDA outlook for the second half of the 12 months and now expects a lack of $315 million, higher than the $380 million it beforehand predicted.

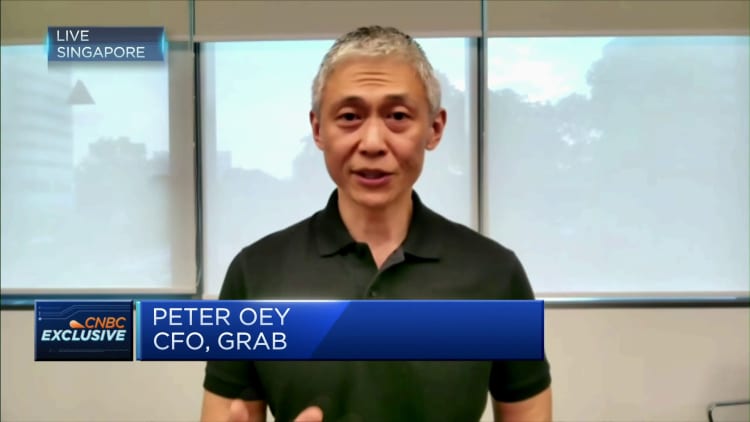

“We’ll goal to raised optimize our value construction by limiting discretionary spending,” Seize CFO Peter Oey stated through the media convention.

“We started pausing or slowing hiring in varied company departments. We have additionally been disciplined to optimize prices in non-headcount overheads,” he added.