Andresr | E+ | Getty Pictures

For retirement “tremendous savers,” good monetary habits seem to go far past fattening up their nest eggs, a brand new research reveals.

Most of those employees — whose 401(ok) contributions are no less than 15% of their pay or 90% or extra of the utmost allowed — additionally pay their payments on time (87%) and do not overdraw their checking account (74%), based on Principal’s 2022 Tremendous Saver Survey.

The report, which comes amid raging inflation, rising rates of interest and a few speak of an financial recession, was based mostly on a current survey of 1,120 people ages 18 to 57 with earnings starting from underneath $35,000 to greater than $500,000. All of these surveyed meet Principal’s definition of an excellent saver.

Extra from Private Finance:

How to save as food inflation jumps more than 11% in a year

Here’s how much you can save by secondhand shopping

Pay isn’t keeping up with inflation. What experts say to do

Whereas the concept of turning into an excellent saver could seem daunting, consultants say that small modifications in habits and life-style can go a great distance in serving to employees enhance contributions.

“I inform people who good cash habits aren’t too removed from good consuming habits,” mentioned Kathryn Hauer, an authorized monetary planner with Wilson David Funding Advisors in Aiken, South Carolina.

“You keep the slimmest when you concentrate on each morsel of meals you set in your mouth, and also you construct probably the most wealth by scrutinizing each penny you half with,” Hauer mentioned.

Tremendous savers drive outdated vehicles, keep away from market worries

Principal requested these surveyed what “sacrifices” they’ve made to save lots of for retirement. For instance, 49% drive an older automotive, 40% do not journey as a lot as they’d like and 39% say they personal a modest house.

Additionally they have taken steps to shift their cash mindset. Many (69%) additionally don’t be concerned about “maintaining with the Joneses,” so to talk, and greater than half do not lose sleep over their funds (56%).

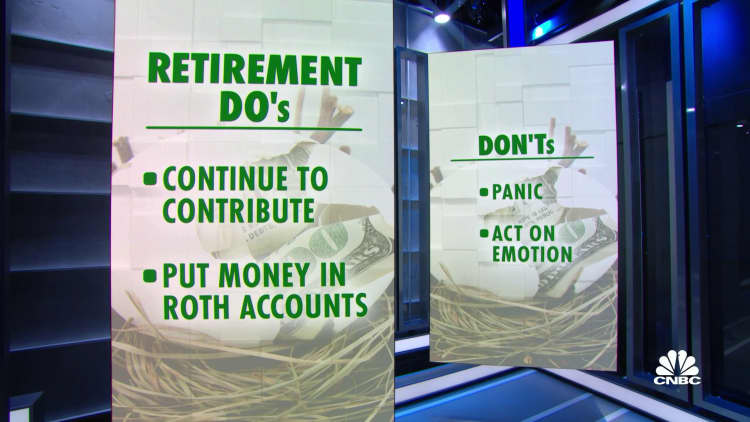

Inventory market volatility has not scared off tremendous savers, both: Practically three-quarters of them contemplate the present market atmosphere a shopping for alternative — one by which they will purchase shares at a reduction.

This view comes within the midst of the most important indexes being down by double digits this 12 months. Via Wednesday’s shut, the S&P 500 had slid 17.2%, the Dow Jones Industrial Average was off 14.4% and the tech-laden Nasdaq Composite had misplaced 25%.

Small modifications in habits can enhance financial savings

Whereas some households could have little to no wiggle room of their finances to save lots of extra for retirement, others may want to switch their spending to release more cash for long-term financial savings.

Hauer mentioned that individuals are inclined to spend more cash when they’re in “an intense emotional second,” which may trigger selections that in any other case could not occur.

“It could possibly be at a boutique looking for the proper promenade gown on your daughter or on the automotive seller if you get swept up by thrilling additional options on [a car],” Hauer mentioned.

If boosting retirement financial savings regularly is difficult together with your present finances, attempt stashing away the occasional more money that comes your means, corresponding to a birthday reward or a few of your tax refund.

“Drop shock money right into a retirement account,” Hauer suggested.

In 2022, employees can stash a most of $20,500 of their 401(ok), with these age 50 or older allowed an additional $6,500 in so-called catch-up contributions (for a complete of $27,000). For particular person retirement accounts, the 2022 contribution restrict is $6,000 (with an additional $1,000 allowed as a catch-up quantity).