The deadline is quick approaching for necessary retirement plan withdrawals, which can pressure some retirees to promote property in a down market. However specialists say there could also be methods to cut back the destructive results.

Required minimum distributions, generally known as RMDs, are yearly quantities that should be taken from sure retirement accounts, corresponding to 401(okay) plans and most particular person retirement accounts.

associated investing information

RMDs begin when you turn 72, with a deadline of April 1 of the next yr in your first withdrawal, and a Dec. 31 due date for future years.

Though it has been a tough yr for the inventory market, there is a steep IRS penalty for lacking RMD deadlines — 50% of the quantity that ought to have been withdrawn.

Extra from Private Finance:

‘Risky behaviors’ are causing credit scores to level off

4 key year-end moves to ‘control your tax reporting destiny’

Despite uncertainty, experts say it’s a ‘great moment’ for dollar-cost averaging

“That is clearly not the opportune time to promote these property, as a result of they’re at a loss,” mentioned licensed monetary planner John Loyd, proprietor at The Wealth Planner in Fort Price, Texas.

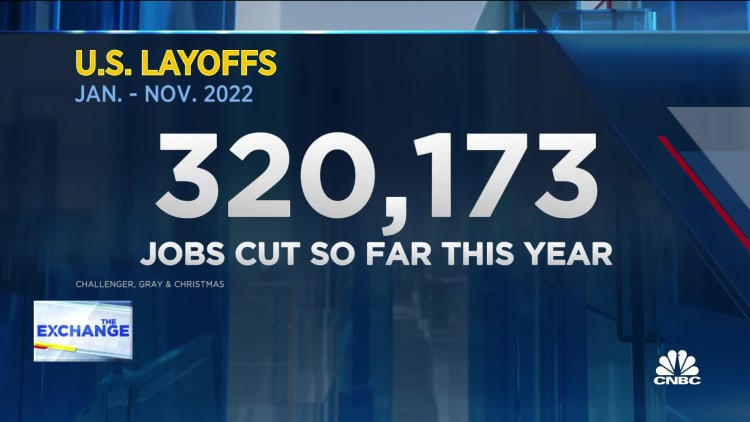

As of mid-day Dec. 7, the S&P 500 Index is down greater than 17% for 2022, and the Bloomberg U.S. Aggregate bond index has dropped almost 12% for the yr.

Why you’ll want to handle the ‘sequence of returns’ threat

Analysis exhibits the timing of promoting property and withdrawing funds out of your portfolio might be “enormously highly effective,” mentioned Anthony Watson, a CFP and founder and president of Thrive Retirement Specialists in Dearborn, Michigan.

The worth of property if you make withdrawals might considerably shift the dimensions of your nest egg over time, generally known as the “sequence of returns” risk, and managing that threat is “the crux of retirement planning,” Watson mentioned.

Contemplate ‘journaling’ to maintain your RMD invested

Should you do not want your RMD for rapid dwelling bills, there are a few methods to maintain the funds invested, specialists say.

One choice, generally known as “journaling,” strikes the property out of your retirement account to a brokerage account with out promoting. “Not lots of people know it,” Loyd mentioned.

Like an RMD, journaling nonetheless counts as a withdrawal for tax functions, which means you may obtain Form 1099-R to report the switch as revenue in your return, he mentioned.

Whereas journaling avoids trip of the market, it is difficult to gauge the precise greenback quantity since market values fluctuate, and it’s possible you’ll want a second withdrawal to completely fulfill your RMD, he mentioned.

Plus, most retirees withhold taxes by way of their RMDs, which is not attainable when journaling property, Loyd mentioned. Sometimes, he makes use of the second withdrawal for tax withholdings.

Both manner, you may wish to construct in sufficient time to finish each transactions by the deadline as a result of “the IRS will not be very lenient in terms of errors,” Loyd mentioned.

Keep away from ‘execution threat’ by promoting and reinvesting

Whereas journaling retains property out there longer, some advisors favor to keep away from “execution threat” by promoting property, withdrawing the proceeds after which reinvesting in a brokerage account.

It takes a few days for RMD funds to settle, however Watson sees journaling as “overly difficult” and prefers to reinvest the funds instantly after the withdrawal clears.