Faucet emergency sources

Attain out to the Federal Emergency Management Agency, Disaster Assistance Improvement Program and the American Red Cross, in addition to state and native governments, for emergency help. You may additionally discover assist in your group.

“Disasters carry individuals collectively,” McClanahan mentioned. “Individuals are actually good at serving to individuals.

“You probably have the flexibility to assist, do it,” she added. “It could be you who wants assist someday.”

Contact mortgage and different lenders if you’ll have bother making mortgage funds.

Put together for insurance coverage claims

If you are going to file an insurance claim, stock the harm earlier than you begin cleansing up.

Make momentary repairs to stop additional harm, however maintain off on everlasting repairs till you have gotten approval for reimbursement. Hold a written document of the title of everybody you speak to about your declare, together with the date of the dialog and abstract of what was mentioned. And hold all receipts.

Perceive your flood advantages

Floods, together with these from a storm surge, are usually not lined by most traditional insurance coverage insurance policies. Protection for floods requires a separate coverage, both from the federally based mostly National Flood Insurance Program or a personal insurer. There’s a 30-day ready interval earlier than flood protection is efficient.

Flood insurance coverage for autos is an choice below the great portion of a coverage.

Know your deductible

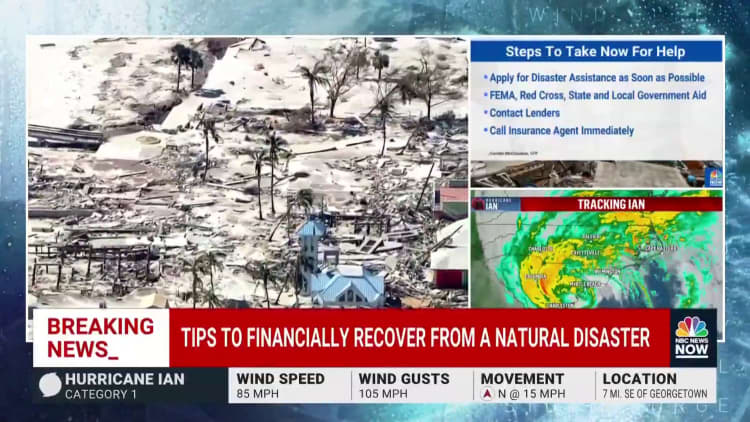

An aerial view of Fort Myers Seashore, Florida, throughout a Coast Guard flight after Hurricane Ian, on Oct. 2, 2022

Miami Herald | Tribune Information Service | Getty Photos

Many property house owners in Florida will face a “hurricane deductible,” which is totally different than the usual insurance coverage deductible. It is sometimes a share of the property worth.

“You probably have a $300,000 home, you possibly can have a $15,000 hurricane deductible earlier than the insurance coverage begins paying,” mentioned Bob Rusbuldt, CEO of the Unbiased Insurance coverage Brokers and Brokers of America.

After Hurricane Ian, Rusbuldt predicts, it is going to be troublesome for customers to seek out property insurance coverage.

Many will now be dealing with even greater premiums and deductibles and should should discover a new insurance coverage firm if theirs pulls out. Many Florida property house owners have already got insurance coverage by way of Citizens, Florida’s state-run insurer of final resort.