Luis Alvarez | Digitalvision | Getty Photos

Each investor appears to be like to purchase low and promote excessive, which sounds easy sufficient … till you attempt to truly put it into follow.

The issue is that it is seldom apparent when the highs and lows of a selected cycle will occur. More often than not, that is obvious solely after the very fact.

A take a look at the present setting exhibits why. On the floor, it appears to be like prefer it might be time to purchase some segments of the market which have taken a beating all through a lot of 2022. However maybe not but.

With inflation easing barely, all the key indexes have jumped since bottoming out in mid-October. In the meantime, Federal Reserve Chair Jerome Powell has signaled that policymakers might improve charges at a slower tempo within the months forward. Due to this fact, shares ought to have room to run going ahead.

Whereas which may be the case for some sectors equivalent to well being care and power, just a few industries are nonetheless more likely to tackle additional losses down the highway, regardless of experiencing features during the last a number of weeks. Software program is considered one of them.

The software program trade loved thunderous peaks through the top of the pandemic-induced lockdowns, solely to tumble sharply extra just lately, with the iShares Expanded Tech-Software Sector ETF (IGV) down greater than 30% this 12 months. For just a few causes, nonetheless, it is most likely greatest to take a deep breath and wait some time earlier than snatching up software program shares.

De-risking occasion

For one, a number of expansions in tech and different curiosity rate-sensitive industries like software program typically happens solely when actual yields (the distinction between nominal yields and inflation) are damaging or close to zero. Although they’ve trended down these days, 10-year actual yields right now stay elevated, hovering round 1.5%.

Second, the enterprise panorama for software program gross sales has turn into tougher. The Fed’s tightening cycle has brought on many corporations to chop spending, primarily by way of headcount reductions. Notably, that features the broader tech universe, which spends billions on enterprise software program options throughout affluent occasions.

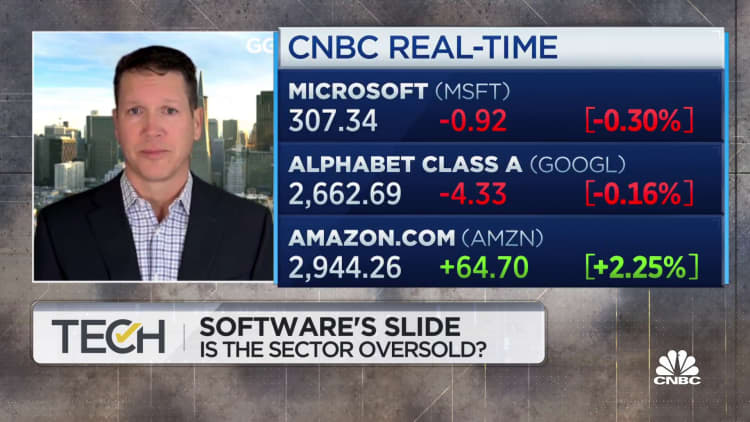

Lastly, earnings have largely dissatisfied, punctuated by misses within the third quarter by as soon as seemingly invincible mega-cap names like Amazon (AMZN), Google (GOOG) and Microsoft (MSFT). The fourth-quarter numbers will seemingly be equally difficult, compelling corporations to regulate their 2023 forecasts.

Collectively, the above forces will create a de-risking occasion through the late winter or early spring of 2023 that can spark extra declines for software program companies. That is when buyers ought to take into consideration shopping for — not now.

Targets might embody the likes of Service Now (NOW), Microsoft and HubSpot (HUBS). All have slumped, lagging behind the efficiency of the broader market, within the case of Service Now and HubSpot considerably. But a coming storm in software program will trigger them to say no additional.

Readability in software program

Is the newest market momentum truly a so-called useless cat bounce that can quickly fizzle out and provides option to extra promoting? Or is it the beginning of a extra substantive rally?

Broadly, it is laborious to know for certain. Markets usually give head fakes.

However on the subject of software program, the image is a bit of clearer. Costs right now are seemingly greater than they are going to be in February and March.

What’s extra, if Fed tightening continues to gnaw at inflation, actual yields might fall much more, offering software program shares a lift from that time ahead — establishing a great buy-low, sell-high state of affairs that each investor craves.

— By Andrew Graham, founder and managing accomplice of Jackson Sq. Capital