Maskot | Maskot | Getty Pictures

People who save for faculty in 529 plans might quickly have a method to rescue unused funds whereas protecting their tax advantages intact.

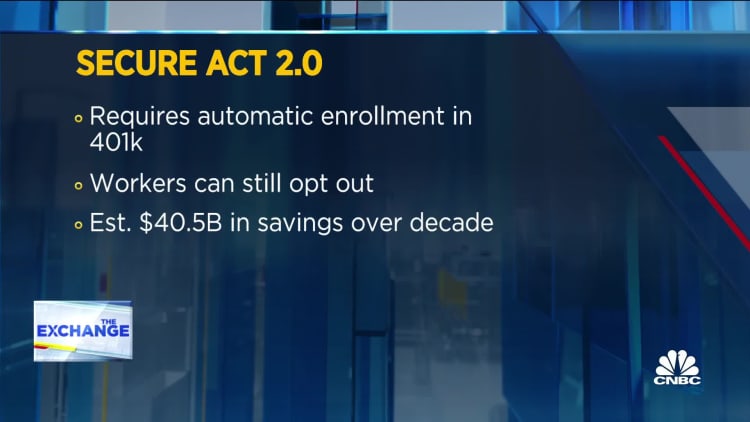

A $1.7 trillion authorities funding invoice passed Thursday by the Senate has a provision that lets savers roll cash from 529 plans to Roth individual retirement accounts freed from revenue tax or tax penalties.

The Home is expected to cross the laws Friday, earlier than a deadline to avert a authorities shutdown.

Extra from Private Finance:

10 ways to avoid the early withdrawal penalty for IRAs

Retirement savers with lower incomes may be getting a federal ‘match’

‘Best’ ways to maximize your tax deduction for charitable gifts

The rollover measure — which, if it turns into legislation, would take impact in 2024 — has some limitations. Among the many largest: There is a $35,000 lifetime cap on transfers.

“It is a good provision for individuals who have [529 accounts] and the cash hasn’t been used,” stated Ed Slott, a licensed public accountant and IRA professional based mostly in Rockville Centre, New York.

That may occur if a beneficiary — reminiscent of a toddler or grandchild — does not attend a school, college, vocational or personal Okay-12 faculty, or different qualifying establishment, for instance. Or, a scholar may receive scholarships that imply some 529 funds are left over.

Tens of millions of 529 accounts maintain billions in financial savings

There have been almost 15 million 529 accounts on the finish of final 12 months, holding a complete $480 billion, according to the Funding Firm Institute. That is a mean of about $30,600 per account.

529 plans carry tax benefits for faculty savers. Particularly, funding earnings on account contributions develop tax-free and are not taxable if used for qualifying education expenses like tuition, charges, books, and room and board.

Nonetheless, that funding progress is usually topic to revenue tax and a ten% tax penalty if used for an ineligible expense.

That is the place rollovers to a Roth IRA can profit savers with stranded 529 cash. A switch would skirt revenue tax and penalties; investments would continue to grow tax-free in a Roth account, and future retirement withdrawals would even be tax-free.

Some suppose it is a handout for the wealthy

Nonetheless, some critics suppose the rollover coverage largely quantities to a tax handout to wealthier households.

“You are giving financial savings incentives to those that can save and forsaking those that can not save,” stated Steve Rosenthal, a senior fellow on the City-Brookings Tax Coverage Middle.

A 2012 analysis carried out by the Authorities Accountability Workplace discovered the standard American with a 529 account had “way more wealth” than somebody with out: $413,500 in complete wealth for the median individual, about 25 instances the quantity of a non-accountholder.

You are giving financial savings incentives to those that can save and forsaking those that can not save.

Steve Rosenthal

senior fellow on the City-Brookings Tax Coverage Middle

Additional, the standard proprietor had a roughly $142,000 annual revenue versus $45,000 for different households, the GAO report stated. Virtually half, 47%, had incomes over $150,000.

The brand new 529-to-Roth IRA switch provision does not carry revenue limits.

Limitations on 529-to-IRA transfers

Whereas the brand new tax break would primarily profit wealthier households, there are “fairly important” limitations on the rollovers that would cut back that monetary profit, Jeffrey Levine, a licensed monetary planner and licensed public accountant based mostly in St. Louis, stated in a tweet.

The restrictions embody:

- A $35,000 lifetime cap on transfers.

- Rollovers are topic to the annual Roth IRA contribution limit. (The restrict is $6,500 in 2023.)

- The rollover can solely be made to the beneficiary’s Roth IRA — not that of the account proprietor. (In different phrases, a 529 owned by a mother or father with the kid as beneficiary would should be rolled into the kid’s IRA, not the mother or father’s.)

- The 529 account will need to have been open for a minimum of 15 years. (It appears altering account beneficiaries might restart that 15-year clock, Levine stated.)

- Accountholders cannot roll over contributions, or earnings on these contributions, made within the final 5 years.

In a abstract document, the Senate Finance Committee stated present 529 tax guidelines have “led to hesitating, delaying, or declining to fund 529s to ranges wanted to pay for the rising prices of training.”

“Households who sacrifice and save in 529 accounts shouldn’t be punished with tax and penalty years later if the beneficiary has discovered another method to pay for his or her training,” it stated.

Are 529 plans already versatile sufficient?

Some training financial savings specialists suppose 529 accounts have ample flexibility in order to not deter households from utilizing them.

For instance, house owners with leftover account funds can change beneficiaries to another qualifying family member — thereby serving to keep away from a tax penalty for non-qualified withdrawals. Apart from a child or grandkid, that member of the family could be you; a partner; a son, daughter, brother, sister, father or mother-in-law; sibling or step-sibling; first cousin or their partner; a niece, nephew or their partner; or aunt and uncle, amongst others.

House owners also can preserve funds in an account for a beneficiary’s graduate education or the training of a future grandchild, according to Savingforcollege.com. Funds may also be used to make as much as $10,000 of scholar mortgage funds.

The tax penalty may not be fairly as unhealthy as some suppose, according to training professional Mark Kantrowitz. For instance, taxes are assessed on the beneficiary’s income-tax fee, which is usually decrease than the mother or father’s tax fee by a minimum of 10 share factors.

In that case, the mother or father “isn’t any worse off than they might have been had they saved in a taxable account,” relying on their tax charges on long-term capital gains, he stated.